Re-orient Express

Last week’s update for the 16-week period to 16 January confirms that Findel (LONDON:FDL) remains on track to deliver strong profits and margin growth. Debt has reduced further with facilities extended. The main driver of continuing progress is Express Gifts, by far the group’s largest business. In our sum-of-the-parts valuation of 310p, Express alone is worth more than Findel’s current market capitalisation.

Recovery led by Express

Following a rescue refinancing in 2011, management has tightened the group’s focus on retailing (Express Gifts, Kleeneze and Kitbag) and education and improved operating effectiveness across the group. Improvement has been most evident and most consistent in its largest business, Express, and continues. Annual product sales growth of 11.1% in the eight weeks to 16 January is encouraging.

Pack up your troubles

Since announcing a strategic review of Kitbag, Findel has received multiple expressions of interest: a sale is possible, albeit not certain. We question the long-term viability of Kleeneze and have ascribed no value to it in our valuation. We assume that uncertainty surrounding the result of May’s general election will depress revenues and profits at Findel Education in the coming months. However, the business is well-placed to benefit from consolidation of a fragmented market.

CEO Roger Siddle to step down

Last week’s announcement that CEO Roger Siddle will step down at the end of March clearly introduces some uncertainty. This should not be overstated. The turnaround is on track and net debt much reduced. Non-executive chairman David Sugden will become executive for a period, returning to a role he filled between March 2010 and March 2011. The rest of the executive team remains intact.

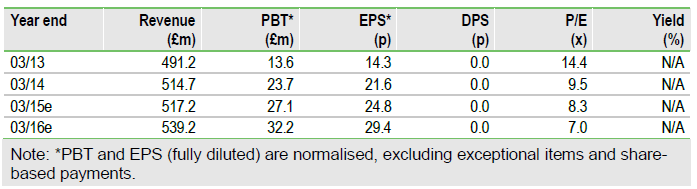

Valuation: Earnings growing, debt reducing

The FTSE 350 general retail sector trades on close to 16x March 2016 earnings. Findel’s FY16 multiple is 7.0x. The Education business is not significant enough to explain the discrepancy. Kleeneze and Kitbag are small in the context of group profits. Perhaps investors are discouraged by the apparently high net debt, not appreciating that most of it finances, and is offset by, the consumer credit book. Adjusting for this, net debt/EBITDA falls from 4.9x to 2.3x. Net debt continues to reduce. Our sum-of-the-parts valuation, using below-sector multiples, values the shares at 310p.

To Read the Entire Report Please Click on the pdf File Below