Reliance Industries

Rating: neutral

RIL reported its first drop in both quarter-on-quarter and year-on-year earnings since Q3FY12, in line with our expectations. While Q3 earnings were negatively impacted by one-off items such as inventory losses, we believe the near-term earnings outlook remains challenging, due to the latest JPM (JP Morgan) commodities research forecast of a lower oil/gas price environment along with potentially weaker GRMs (gross refining margins) as another mega-refinery starts in Saudi Arabia. Our latest FY16 net profit forecast is 17% below consensus and implies an 8% y-o-y drop in earnings. Despite our incrementally more negative outlook, we maintain Neutral given RIL’s underperformance vs the Sensex in 2014.

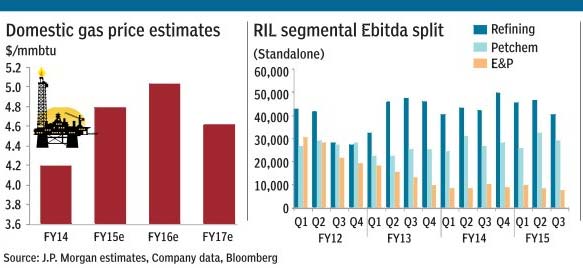

We reduce our FY15/16 earnings by 5%/8%: With a lower oil/price forecast, we cut our profit forecast for both KG D-6 gas fields and US shale projects and assume little recovery of inventory losses in Q3 (and likely Q4 as well). We also cut assumed incremental earnings from the petcoke gassifier project for FY17. Output at the D6 field declined further q-o-q, averaging 11.8 vs 12.5mmscmd (million metric standard cubic metre per day) for Q2. We note that a further drop in production due to lower gas prices remains a downside risk for the upstream segment.

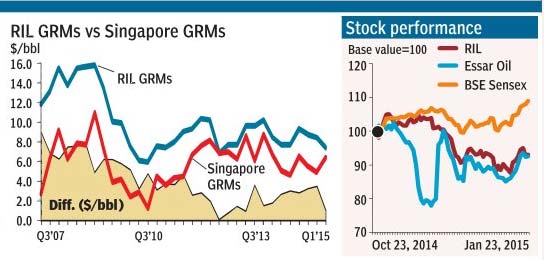

Q3FY15 NP (net profit) was -12% q-o-q and -4% y-o-y, with inventory losses impacting the downstream businesses. Refining margins were relatively resilient, at $7.3/bbl (vs Q2 GRMs at $8.3/bbl), maintaining a premium over regional benchmarks. Petchems were weaker q-o-q, with inventory losses and lower prices impacting effective realisations. Other income was 16% higher q-o-q, with realised profits on investments.

New Sep-15 PT of R915: The cut in our PT (price target) is mainly driven by lower profits forecast for the upstream business and cutting multiples used for the refining/petchem businesses given our relatively bearish outlook, especially in a lower oil price environment. Uncertainty around RIL’s telco strategy remains an important stock overhang in the near term.

Lower oil/gas price forecast is negative for earnings outlook: We adjust our FY15e/16e/17e earnings by 5%/8%/10%, and cut our SOTP(sum of the parts)—based PT to R915. With our expectation of lower gas prices ($5.03-$4.62/mmbtu in FY16/17), and uncertainty over timelines of arbitration/applicability of deepwater premiums, we see a slower ramp-up of production in the domestic E&P (exploration and production) business, and likely lower profitability. We adjust our shale earnings lower on account of a softer outlook for HH (Henry Hub)/crude prices.

Also with our assumption of a continuing low crude environment, we expect a lower benefit from the petcoke gassification project (c.$2/bbl uplift to GRMs vs $2.5/bbl previously). With downside risks to refining/petchem earnings, we cut multiples for these businesses to 6x/7x (from 6.5x/7.5x). Despite petchem capacity growth, our new FY16 forecast is 17% below consensus and implies an 8% y-o-y drop in net profit.

Inventory losses impact Q3 earnings

RIL consolidated profit after tax was down 12% q-o-q and 4% y-o-y, with inventory losses (due to sharply lower crude) impacting the downstream businesses. Refining margins were relatively resilient, at $7.3/bbl (vs Singapore GRMs at $6.3/bbl, and RIL Q2 GRMs at $8.3/bbl), maintaining a premium over regional benchmarks through advantaged crude sourcing (increasing usage of advantaged Latin American grades, and usage of Brent linked crudes) and product slate flexibility. Other income was 16% higher q-o-q, with realised profits on investments. Petchems were weaker q-o-q, with inventory losses, and lower prices (to push products into an uncertain market) impacting effective realisations.

Refining margins fell to $7.3/bbl (from $8.3/bbl in Q2) despite higher headline benchmark margins, due to inventory losses from the sharp fall in crude prices. Throughput was higher at 17.7mmt (million metric tonne). Petchems contribution was 9% lower q-o-q, with inventory losses, and price volatility impacting realisations.

Gas production was slightly lower q-o-q (11.8mmscmd). RIL is continuing work on arresting the decline in production, with workovers and sidetracks in MA and D1-D3. Earnings from E&P were lower q-o-q, despite the higher gas price.

Retail continues to grow – a mix of strong same-stores sales growth and new stores opening helped increase turnover by 19% y-o-y basis. RIL now operates 2,285 stores in over 150 cities in India.

Refining– relatively resilient despite inventory losses: RIL GRMs for Q3 stood at $7.3/bbl (barrel). While headline GRMs rose to $6.3/bbl in the quarter (vs $4.8/bbl in 2Q), inventory losses offset these gains, with RIL continuing to maintain a premium. Flexibility in the product slate (naphtha output lower 20% q-o-q; jet fuel output up 35% q-o-q), and advantaged crude sourcing helped earnings. Throughput rose to 17.7 mmt during the quarter.

The company believes that demand could improve incrementally in a lower price environment, and sees capacity additions slowing to match demand better. Gasoil (diesel) cracks averaged $16/bbl during the quarter vs $14.4/bbl in Q2, with lower crude helping improve cracks. With many refiners ramping up jet fuel production, gasoil gained strength as well. Naphtha cracks were subdued, with muted demand and inflows from the west. Gasoline cracks held up better, with outages and robust Indonesian demand. However, a return of refineries, along with price increases in Indonesia, cracks moderated towards the end of the quarter.

—JPMorgan