Whether Ultratech Cement, India’s largest cement maker and a part of the Aditya Birla Group, will go ahead with its bids for Lafarge-Holcim’s international assets or pull out has been a matter of intense speculation over the last two months. But the expected revival of economic growth and consequently, cement demand, in India, and Ultratech’s own greenfield expansion plans are enough to ensure that it maintains its leadership position in this sector, even if it doesn’t bid for these assets or bids unsuccessfully.

The Kumar Mangalam Birla-led firm has been one of the most aggressive cement makers in India in terms of capacity creation over the last one decade (FY05-FY14), adding nearly 30 million tonnes (mt) in this period. Its current aggregate production capacity stands at 63.4 mt per year, which includes an overseas capacity of 3.2 mt.

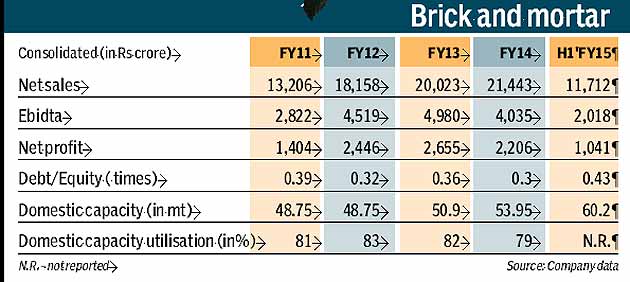

While overall capacity utilisation in the cement industry has been impacted due to the slowdown in the Indian economy (it stood at 68-70% in fiscal 2014), Ultratech’s capacity utilisation has remained relatively strong at 79% last fiscal. Ultratech’s operating profit or Ebitda (earnings before interest, tax, depreciation and amortisation) has grown 18.6% in the last four years.

While overall capacity utilisation in the cement industry has been impacted due to the slowdown in the Indian economy (it stood at 68-70% in fiscal 2014), Ultratech’s capacity utilisation has remained relatively strong at 79% last fiscal. Ultratech’s operating profit or Ebitda (earnings before interest, tax, depreciation and amortisation) has grown 18.6% in the last four years.

In fiscal 2014, the company spent R2,562 crore, mainly towards capital expenditure to grow its grey cement capacity by 3.05mt and captive power generation capacity by 80 MW. Last fiscal it also increased its production capacity in Gujarat, where its existing plants have been operating at 95%, by purchasing two cement plants with a capacity of 4.8mt from the debt-laden Jaypee group for an enterprise value of R3,800 crore.

In the first half of fiscal 2015, Ultratech has increased its captive power capacity by another 57MW to 733MW, nearly 80% of its overall power requirement. The ongoing capex has led to the company establishing a uniform presence across India with the northern, southern, western and eastern/central regions contributing 21%, 26%, 27% and 25% respectively to its overall capacity.

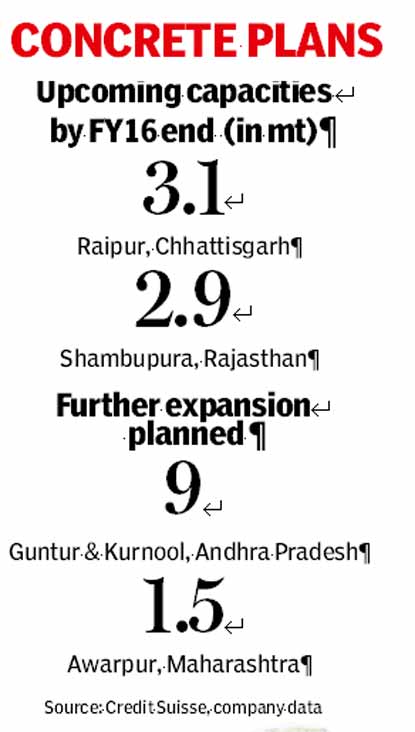

Ultratech’s R10,000 crore-capital expenditure programme is aimed at increasing its capacity by another 6mt by March 2016, which would take its overall capacity to around 70mtpa.

A Credit Suisse research report in November stated that the firm has received approval from the Andhra Pradesh government to set up two cement plants at Guntur and Kurnool totalling 9.5mt capacity, while public hearing for a 1.5mt brownfield expansion of its plant at Awarpur, Maharashtra had concluded.

A quarterly earnings review report issued by JP Morgan in October stated that Ultratech had given analysts to understand that it required to add 7-10mt of capacity every year to maintain market share. “The current round of capacity additions will be over in FY16 and the company said it had been making land purchases and would announce new projects at an appropriate time,” the JP Morgan report said.

Though analysts are convinced that Ultratech has the financial muscle to execute big-ticket global acquisitions, such as that of Lafarge-Holcim’s assets, they observe that the company might choose to focus more on domestic market for growth for the time being.

“With a debt to equity ratio of 0.3, we think Ultratech has the balance sheet strength to buy 8-10mt of Lafarge-Holcim’s assets in emerging markets, by levering up to 1:1 (debt to equity),” a UBS research report said. We think Ultratech’s key focus is likely to be India, as the economy and the industry are recovering from cyclical lows”.

As on September 30, Ultratech had consolidated net debt of R5,560 crore, including the debt associated with the plants acquired from the Jaypee Group.