With the new government promising better fuel linkage and a more efficient national grid for India’s power sector, JSW Energy’s latest big-ticket acquisition appears to be a smart move to align a greater portion of its portfolio to fixed power purchase agreements (PPAs), moving away from the merchant power producer model it has relied on thus far.

At present, around 81% of the 3,140 MW of power that JSW Energy produces is sold in the merchant market, which is more remunerative than fixed sales agreements with state-run power distribution firms, but lacks the steady nature of cash flow from fixed long-term contracts.

In September, the Sajjan Jindal-led power generation firm entered into an understanding with Jaiprakash Power Ventures (JPVL), a part of the debt-laden Jaypee Group, to acquire two of its hydroelectric power plants for R9,700 crore. JSW Energy deferred a decision to buy another 500 MW thermal power plant from JPVL, pending further clarity on coal linkage for the project.

“Given that both the projects (that JSW Energy is acquiring) are tied up under long term PPA, the overall mix of the capacity has tilted in favour of PPA at 65%, while 35% of capacity is under merchant basis,” a report by domestic brokerage Motilal Oswal said.

The average price of merchant power in the spot market is around R3.8 per unit currently, according to data available with energy exchange IEX, while recently-signed PPAs have seen power producers get as much as R4.5 per unit.

To be sure, JSW Energy’s deal with JPVL will take a few months to materialise, pending necessary approvals. If the current trend in PPA-linked power prices vis-à-vis spot market prices continues, JSW Energy will stand to gain substantially from the acquisition.

JSW Energy declined to participate in the story.

Analysts point out that any further upside in merchant power prices in India is limited. The southern states see the largest demand for merchant power since a number of the gas-based power plants that have signed PPAs with the state governments in this region are non-operational due to shortage of natural gas. As a result, merchant power prices in south India have been, on an average, 91% higher than in the rest of the country (from FY12 to FY14), according to Ambit Capital.

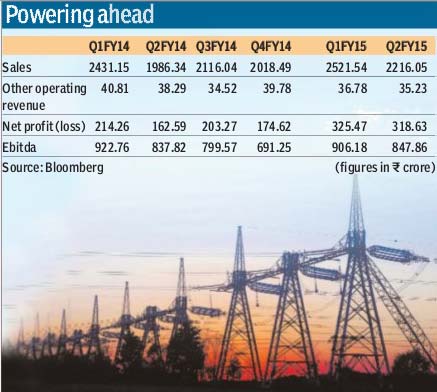

JSW’s revenues of R8,934 crore in FY13 was almost seven times that its turnover in FY09, reflecting the rise in demand and prices for merchant power in the country. In FY14, however, JSW Energy’s net sales declined 3% to R8,705 crore.