With the Competition Commission of India (CCI) giving conditional approval to Sun Pharmaceutical Industries’ proposed acquisition of Ranbaxy Laboratories, the stage is set for Sun Pharma to become the largest pharmaceutical company in India, that too without losing much in the process.

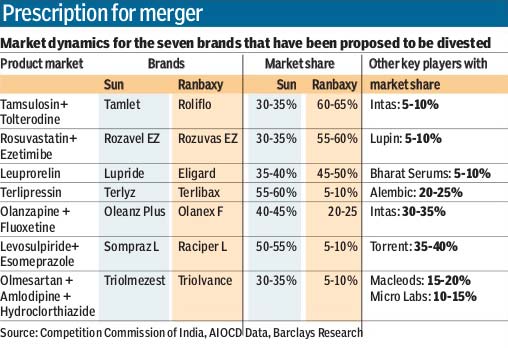

On December 8, eight months after Sun Pharma issued a statement announcing it had agreed to acquire Ranbaxy from Daiichi Sankyo for $3.2 billion, the CCI gave its nod to the deal with the rider that the two entities would have to divest seven products between them (one Sun Pharma product and six Ranbaxy drugs) in the next six months. These seven products have a combined turnover of R48 crore, which amounts to 0.3% of the total sales of these two companies in FY14, according to an Edelweiss Securities report.

To be sure, Sun Pharma and Ranbaxy may have to divest a couple of more products which it sells in the US.

Apart from the Punjab and Haryana high courts, the deal still needs to be approved by the US Federal Trade Commission (USFTC), which may direct the firms to sell some more of its products to avoid monopoly.

“Ranbaxy’s largest product in the US is Absorica where Sun has no presence and Sun Pharma’s most significant products in the US are Doxil, Taxotere and Azelastine spray, where Ranbaxy has no meaningful presence,” an Ambit Capital report said. “Hence, we would not expect USFTC to ask for divestment of more than one or two products.”

While the deal is significant for the two companies in question, it is also a landmark event as the CCI, for the first time, got into a detailed investigation of the business impact of a proposed deal, known as Phase II investigation.

Approval for the deal with caveats that are unlikely to materially impact the fortunes of the two companies is also an indication that CCI nod for acquisitions is unlikely to be a hurdle for companies in India.

“It is worth noting that the number of products (that the CCI has asked these two companies to sell) is significantly smaller than the 37 products highlighted by Sun Pharma and Ranbaxy in their submissions to the CCI,” the Edelweiss report said.

CCI began examining the consequences of the merger on May 6 and on July 7, the regulator concluded that prima facie the proposed combination is likely to cause an “appreciable adverse effect on competition in relevant markets in India”, and after discussions with the companies, asked them to provide information on the merger.

“The merger application was a highly complex, first time, phase II merger in India and involved a sector that is sensitive and subject to much public scrutiny,” a statement issued by law firm Khaitan & Co., which helped draft Sun Pharma’s responses to the CCI, said.

The law firm said that the mandate it got from Sun Pharma was innovative as it was for the first time that a drafted law was being tested in an actual situation. “(It) involved working very closely with the regulator in achieving a balance between the concerns of the regulator and the commercial expectations of the parties involved, not to forget, the many stakeholders that have an interest in ensuring that the merger goes through smoothly,” the firm said.

“Competitive position (of Sun Pharma and Ranbaxy) is unlikely to be diluted although the CCI directive avoids monopoly situations in these brands,” a Barclays equity research report said.

Sun Pharma’s acquisition of Ranbaxy will create India’s largest drug company with combined revenues of R7,070 crore and a market share of over 9%.