- India

- International

A new deal for the states

As states face a renewed fiscal crisis, the Modi government should shed Delhi’s old patronising ways, restructure states’ debt.

A countercyclical fiscal policy, providing for higher borrowings in a downturn and stringent limits when growth returns, needn’t be a bad thing.

A countercyclical fiscal policy, providing for higher borrowings in a downturn and stringent limits when growth returns, needn’t be a bad thing.

Last week, Finance Minister Arun Jaitley, at a civil society interaction in Srinagar, reportedly said that “gone are the days when the Centre would provide money and the states would run the government”. Today, “every state has to stand on its own”.

For states, such kind of sermonising may not be new. But what is striking in this case is that it is coming from the finance minister of a government whose mascot — Prime Minister Narendra Modi — is someone well acquainted with the problems of states, having run one for over 12 years. Jaitley’s comments nevertheless provide an opportunity to examine the fiscal management record of state governments in the recent past, and also comparing this with the Centre’s.

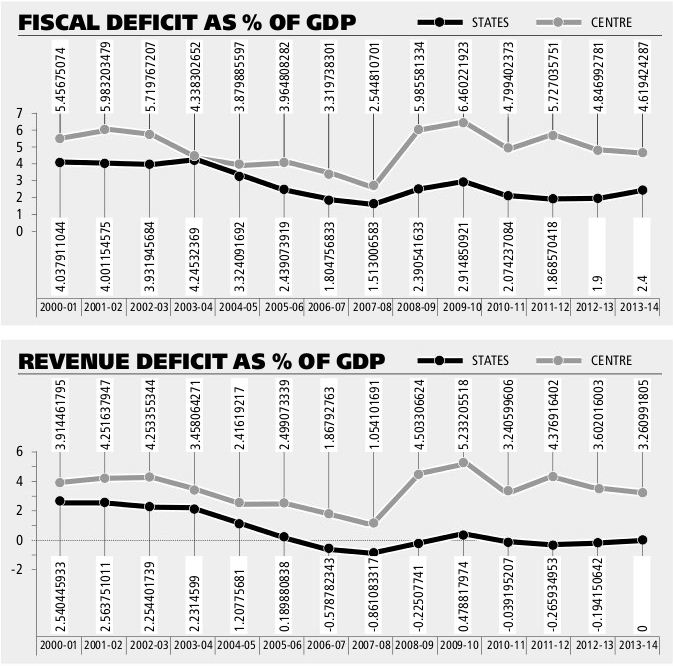

The period from 2003-04 to 2011-12 was a good one for the Indian economy. With gross domestic product (GDP) growing by an average 8.3 per cent a year, tax and non-tax revenue collections surged. As a result, the combined fiscal deficit of the states fell from 4.25 to 1.9 per cent of the GDP, even as their revenue deficit of 2.25 per cent turned into a surplus of 0.3 per cent.

The Centre’s record, on the other hand, was more mixed. While its deficits registered sharp dips between 2002-03 and 2007-08, the period thereafter saw sharp deterioration, so much so that both the fiscal and revenue deficits in 2011-12 were higher than their corresponding levels for 2002-03 (see accompanying charts).

Although the states, too, were hit by the global economic crisis post-2008, their finances did not go as much into the red. They were, at the end of the day, better-off relative to the early 2000s.

States, in short, have generally demonstrated more prudence than New Delhi in managing their finances. While there are outliers — West Bengal and Punjab, in particular — the bulk of them have stayed the course in keeping fiscal deficits below 3 per cent of state GDPs and eliminating revenue deficits, as required under their respective fiscal responsibility and budget management (FRBM) laws. This contrasts with the Centre’s dismal record at meeting its own FRBM commitments.

True, the above improvement in state finances was brought about no less by increased Central transfers. This was thanks to the 12th Finance Commission recommending a 30.5 per cent share for states in net Central taxes effective from 2005-06 (as against the earlier 29.5 per cent), besides overall growth-induced revenue buoyancy.

States further benefited from a scheme formulated by the last NDA government, enabling them to swap some Rs 1,06,000 crore of past Central loans contracted at interest rates of 13 per cent and more with lower-cost small savings and open-market borrowings.

But the major source of turnaround was the states’ own efforts at revenue mobilisation. The own tax revenues of Karnataka and Tamil Nadu, for instance, amounted to between 10 and 12 per cent of their state GDPs in 2007-08, which wasn’t far behind the corresponding ratio of 12.6 per cent for the Centre. Given that the bulk of taxation powers — whether on income, manufacturing (excise), imports (customs) or services — is concentrated at the Centre, this was no small achievement.

Unfortunately though, all these gains are under threat now. The last two years have seen the country’s average GDP growth plummet to 4.6 per cent; that figure is unlikely to cross 5.5 per cent in 2014-15. States are already beginning to feel the pinch of the ongoing economic slowdown in three broad ways.

The first is that their own revenues — including from taxation of sales, property transactions and stamp duties/ registration fees — are being affected. The second is through lower Central tax revenue collections that, in turn, translate into reduced transfers. The third is via cuts in Plan as well as non-Plan assistance from the Centre, which is essentially a means of passing on its fiscal problems to the states.

The significant thing to point out here is that it is the states that incur the bulk of development expenditures in India — be it on primary health centres, schools, roads, irrigation or sanitation. This also makes sense, considering that they are the ones closer to the people rather than the Centre.

But matters are different when it comes to resource mobilisation. The lack of flexibility for the states here extends not just to taxation. Article 293(3) in the Constitution bars them from even raising loans without the Centre’s consent. The FRBM laws only add to their problems, especially in the current context when revenues are taking a hit. States, then, have little option but to cut back on development and social spending that hardly generate any financial returns.

It is time, perhaps, to review the straitjacket imposed by the FRBM laws enacted by the states, amending which again requires Central approval. A 3 per cent cap on fiscal deficit — annual gross borrowings — may have originally been inspired by the Maastricht Treaty that led to the creation of a single European Union currency. Whether such a benchmark, designed for developed economies, is valid for states in India, whose citizens are deprived of even basic physical and social infrastructure, is worth thinking about.

Moreover, we are probably now entering a low interest rate regime, which may give some elbow room for states to borrow more from the market. There is nothing wrong in allowing them to do so, so long as these are for financing capital and development works. A countercyclical fiscal policy, providing for higher borrowings in a downturn and stringent limits when growth returns, needn’t be a bad thing. It would be interesting to see if the 14th Finance Commission, which is slated to submit its report soon, recommends anything along these lines.

This government would do well to learn the lessons from the early 2000s. Both the NDA and the first UPA governments during that time took sensible steps to swap and restructure the debts of states. States deserve a similar “New Deal” today, when their finances are under strain from a prolonged slowdown. After all, to quote Modi himself, the development of states is the key to the development of India.

But all this requires Delhi to shed its old patronising approach, apart from taking credible measures to set right its own finances. Only that will give it the moral authority to preach from the pulpit.

shaji.vikraman@expressindia.com, harish.damodaran@expressindia.com

40 Years Ago

EXPRESS OPINION

More Explained

Apr 16: Latest News

- 017 hours ago

- 0217 hours ago

- 0317 hours ago

- 0410 hours ago

- 0517 hours ago