Inside Flipkart’s complex structure

Flipkart has devised a complicated maze of inter-connected and purportedly independent entities that receive massive amounts of money it raises to build an integrated e-commerce business

Premium

Premium

New Delhi/Bengaluru: In 2007, when engineering graduates Sachin Bansal and Binny Bansal (unrelated) opened a site called Flipkart.com to sell books, the business was relatively simple and straightforward.

So was the company’s corporate structure.

The Bansals set up an entity called Flipkart Online Services Pvt. Ltd which owned Flipkart.com and sold books directly to consumers. Since then, Flipkart has become the country’s largest e-commerce site, is worth $7 billion, has attracted as much as $1.8 billion from investors, sells all kinds of products and employs more than 20,000 people. The Bansals, on their part, have become the poster boys of India’s e-commerce business and the envy of the larger corporate world.

It is just one measure of how different things are now that the original entity, Flipkart Online Services, no longer does any significant business for Flipkart.

This is in short what Flipkart does: it sources goods from manufacturers, sells those goods to many of its third-party sellers who then, in turn, offer those products to shoppers. Flipkart provides the technology platform and logistics services and takes a commission on every sale on its site.

This isn’t how a pure marketplace—Flipkart claims to be one—operates. Which is why Flipkart has had to set up a complex web of at least nine entities.

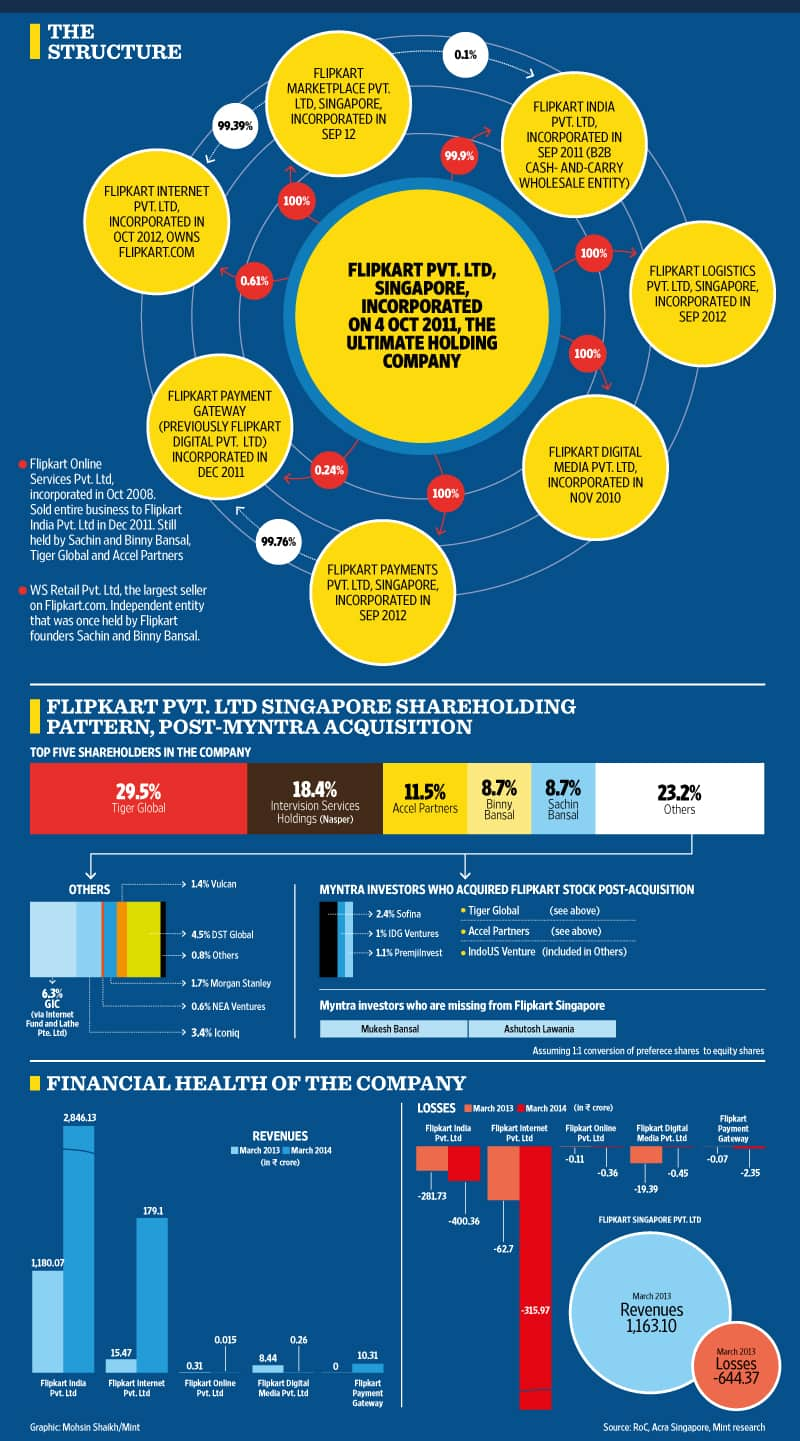

Today, after nearly six rounds of investments from more than 15 investors and several acquisitions, Flipkart’s corporate structure would make older Indian conglomerates proud. Most of Flipkart’s entities finally lead to the ultimate holding entity, Flipkart Pvt. Ltd (FPL), which was set up in October 2011 in Singapore, according to documents available with the Singapore government.

These documents, accessed by Mint, show there are three entities registered in Singapore as 100% subsidiaries of FPL: Flipkart Marketplace Pvt. Ltd, Flipkart Logistics Pvt. Ltd and Flipkart Payments Pvt. Ltd. These companies, in turn, hold stakes in five Indian entities: Flipkart India Pvt. Ltd, the wholesale cash-and-carry entity; Flipkart Internet Pvt. Ltd, which owns Flipkart.com and provides technology platform to e-commerce companies; Digital Media Pvt. Ltd, currently a dormant company, formerly known as Digital Marketplace Pvt. Ltd ; Digital Management Services Pvt. Ltd that ran Letsbuy.com; and Flipkart Payment Gateway Services Pvt. Ltd, which ran payments product payzippy and is currently in middle of restructuring its operations and will continue to focus on payment services.

This structure traces its roots back to late 2008, when the Bansals first went looking for investors to pump money into their business. Since FDI wasn’t allowed in direct online retail, the company had to be restructured to accommodate foreign money. So, in June 2009, a few months before they received their first investment of $1 million from Accel Partners, the Bansals set up WS Retail as the company’s consumer facing entity and Flipkart Online Services (FOS) was turned into a wholesale cash-and-carry business. But this structure, too, did not last very long. In 2011, FOS sold its entire business (brand, technology, employees and business contract) to Flipkart India Pvt. Ltd. Today, FOS is not even a part of the ultimate holding company Flipkart Singapore, although it exists as an independent entity in which around 62% is held by the Bansals and about 33% by Tiger Global Management.

Since then, Flipkart has added several other entities, partly to make room for acquisitions such as that of online electronics retailer Letsbuy in 2012.

To Mint’s emailed queries on Flipkart’s holding pattern, the company responded: “Being a privately held company, we do not comment on our structures or shareholders."

The ownership of FPL Singapore largely rests with Tiger Global, Accel Partners, Naspers and the Bansals. Tiger Global, the US-based hedge fund that holds close to 30% in the parent company, has two seats on the board.

The documents filed with Accounting and Corporate Regulatory Authority (Acra), Singapore, also show just how important Flipkart has become to Tiger Global Management. According to the documents and people familiar with matter, Tiger Global has invested more than $700 million in Flipkart so far. That is significantly higher than what the firm invested in the likes of Facebook and Alibaba, making Flipkart one of Tiger Global’s biggest bets ever.

FPL, the group’s holding entity, posted a loss of ₹ 644.37 crore on revenue of ₹ 1,163.1 crore in 2012-13, according to documents filed with the Singapore government. The parent company is yet to file its latest financial results in Singapore.

For the year ended 31 March 2014, the losses of all Flipkart India entities amounted to ₹ 719.5 crore on revenue of ₹ 3,035.8 crore, according to data compiled by Mint from the Registrar of Companies (RoC) and Acra. Flipkart Marketplace Singapore alone posted a loss of ₹ 3.55 crore on zero revenue for the year ended 31 March 2014.

The five Indian entities reported sales of ₹ 1,195.9 crore and losses of ₹ 344.6 crore for the fiscal ended 31 March 2013. Myntra Holdings, which is now part of Flipkart Pvt. Ltd, Singapore, has not yet filed its results in India.

The documents also show how the Myntra acquisition in May, for an estimated value of $330 million, has opened doors for investors such as IndoUS Venture Partners, IDG Ventures and PremjiInvest to become part of Flipkart.

After the merger, all Myntra shareholders except co-founders Mukesh Bansal and Ashutosh Lawania got stock in Flipkart Singapore. PremjiInvest now holds close to a 1.1% stake, Indo-US Ventures holds 0.6%, IDG Ventures holds 1%, Accel moved up to 11.5% and Tiger Global’s stake jumped to 30%.

Both Myntra co-founders received cash from Flipkart for their stakes, people familiar with the matter said. Neither Bansal and Lawania own any stake in Flipkart, the documents show. Mint could not verify how much Bansal and Lawania received from Flipkart.

Mukesh Bansal now sits on the board of Flipkart India and continues to hold some stake in Myntra Holdings. He was also promoted to the role of Flipkart’s marketing chief earlier this month.

Then there’s WS Retail, one of the most important pieces of the Flipkart puzzle. WS Retail was owned by Flipkart co-founders until September 2012. The Bansals and two of their relatives were also board members at WS Retail. In September 2012, Flipkart was forced to sell a large stake in WS Retail to former OnMobile Global Ltd chief operating officer Rajeev Kuchhal, just weeks before Indian regulatory agencies launched an investigation into the company’s business relationship with WS Retail, Mint reported on 6 October. Both the Bansals and their relatives gave up their board seats, too. Tapas Rudrapatna and Sujeet Kumar control 46% of WS Retail, documents with the Registrar of Companies show. Rudrapatna and Kumar were employed by Flipkart at least until September 2012. WS Retail still accounts for more than 75% of Flipkart’s business, according to three other people familiar with the matter. WS Retail and Flipkart used to share offices until recently and continue to share at least one warehouse location in Bengaluru, though both companies have different spaces in the warehouse, one of the people cited above said.

None of the people Mint spoke to in an effort to understand the complicated Flipkart structure wished to be identified.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!