- India

- International

Good news from textile sector: exports to US, No. 1 single market, hit record high

The turnaround is significant as India has been steadily losing ground to Bangladesh, Vietnam and Indonesia in the US market.

The pick-up in performance, visible in the export of Indian apparel and textiles, is also matched by a revival of sorts visible in domestic sales.

The pick-up in performance, visible in the export of Indian apparel and textiles, is also matched by a revival of sorts visible in domestic sales.

The Centre’s ‘Make in India’ pitch seems to have already found resonance in the country’s textile and garment industry, with India’s exports to its largest single market, the US, headed for a record surge this year.

While a renewed buoyancy in textile and apparel exports is helped by a sharp improvement in raw material supplies, the strong performance by India this year is also a reflection of a combination of global factors — a steady improvement in demand as the American economy picks up, a progressive decline in Chinese exports to major markets such as the US, currency appreciation in Indonesia, labour unrest in Asian competitor Cambodia and safety concerns after a major factory fire in Bangladesh last year.

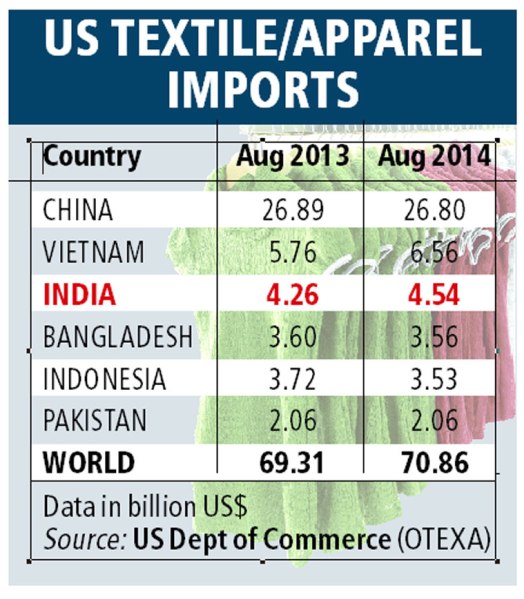

Indian textile and apparel exports have risen nearly 7 per cent during January-August 2014, according to the US Department of Commerce’s Office of Textiles and Apparel (OTEXA) data, compared with an average 2 per cent annual growth in the last five years. The growth in exports this year is being seen as significant as it happened despite the sharp strengthening of the Indian rupee since September 2013 (a stronger domestic currency results in a loss of competitiveness for exporters and vice versa).

While the steady pick in US demand is a major factor, larger domestic cotton supplies are also helping India push textile and apparel exports, Ajay Sardana, vice-president of Aditya Birla group firm Grasim said on the sidelines of a recent conference. India is projected to be the world’s top cotton grower this year, ahead of China for the first time in over three decades, according to a September 12 US Department of Agriculture forecast that has been corroborated by the Cotton Association of India.

Virender Uppal, Chairman, Apparel Export Promotion Council, said, “We (Indian exporters) have leveraged our raw material strengths and followed sustained better compliance practices, which attracted the buyers and international brands across globe to source from India.”

Added to this is a series of problems encountered by India competitors. Cambodia, in June this year, saw labour unrest as angry workers rampaged through a textile plant that supplied US sportswear company Nike Inc, clashing with police over their demands for a pay hike. The collapse of the Rana Plaza garment factory in Bangladesh last year has had a continuing impact in terms of orders being diverted to India and other markets because of concerns over Bangladeshi workshop safety while textile manufacturers in Vietnam, one of the fastest growing supplier base, have been weighed in by the high cost of credit.

Both Bangladesh and Cambodia have seen a contraction in exports to the US, a factor that has helped India alongside the continuing slowdown in Chinese supplies on account of surging labour costs. Indonesia, another major exporter, too recorded a sharp contraction in the growth in export shipments to the US during this period, primarily on account of the Indonesian rupiah’s appreciation since January 2014.

A mid-level exporter based in Gurgaon confirmed that orders from its US clients that include JC Penney, GAP and Pier 1 have surged over 10 per cent for the winter 2014 season and his two units are executing those currently.

The pick-up in performance, visible in the export of Indian apparel and textiles, is also matched by a revival of sorts visible in domestic sales. The improvement in India’s textile sector, primarily linked to the surge in shipments to the US, is visible in the domestic industrial output numbers. The IIP (index of industrial production) estimates for April showed a sharp 7 per cent increase under the textiles head, coming in the wake of strong performances in both March and February.

Readymade garments played a significant role in India’s double-digit export growth in May, clocking a 25 per cent increase (year-on-year).

The turnaround is significant as India has been steadily losing ground to Bangladesh, Vietnam and Indonesia in the US market for apparel and textile products.

While China’s hold over the US market has been loosening on account of increasing labour wages and power shortages, India, which was widely seen as being in the best position to capitalise on China’s lost market share, had been increasingly relegated to the position of a supplier of intermediate products to other successful garment exporting countries.

Unlike markets such as China, Vietnam and Cambodia though, India continues to retain a competitive edge in terms of lower labour costs, according to D K Nair, secretary general of the Confederation of Indian Textile Industry.

May 05: Latest News

- 01

- 02

- 03

- 04

- 05