By Ivan Y.

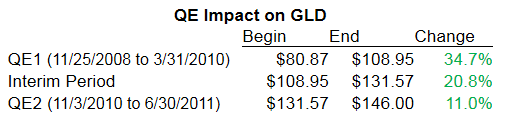

Next week, the Fed is expected to complete the tapering process and bring QE3 to an official end. How will this impact the popular SPDR Gold Trust ETF (NYSEARCA:GLD) in the weeks and months that follow? A look at how GLD performed after QE1 and QE2 could provide a clue. QE1 was announced on November 25, 2008 and concluded on March 31, 2010. What followed was several months without any QE. QE2 was announced on November 3, 2010 and concluded on June 30, 2011. The two charts below show how GLD performed during QE1 and QE2 and in the weeks and months that followed the conclusion of these programs.

(Data Source: Historical prices obtained from Yahoo Finance)

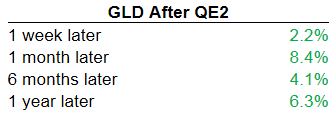

The data clearly shows that GLD benefited greatly from both QEs. GLD gained about 35% during QE1 and 11% during QE2. What is surprising is that GLD did not suffer at all during the interim period between QE1 and QE2. Perhaps it was still recovering from an oversold condition or perhaps investors/traders were expecting that the Fed would have to initiate another round of QE. Another surprise was that GLD continued to climb higher after QE2 officially ended.

QE3

This brings us to QE3. It began in late 2012 and to the great disappointment of many gold investors, gold has dropped significantly since then. It's pretty easy to explain why gold did not respond to QE3 positively. The fact is that the high inflation rates that many gold investors were expecting due to money printing did not materialize. In September, CPI inflation was at 1.7% year over year. As a result of the tame inflation these past couple of years, many momentum players in the futures market abandoned their positions and perhaps even went short, thus driving gold down. On top of that, gold broke down technically last April when it couldn't hold support at $1550.

So here we are. The Fed has successfully prevented a global depression and reinvigorated both the stock and housing markets without triggering any significant inflation.

Post-QE3

So what will happen after QE3 concludes? The data above shows that gold does not necessarily have to go down after QE ends. Gold responded quite well in the weeks and months after the conclusion of both QE1 and QE2, even though logically one would think that the ending of QE would hurt gold. Therefore, I think it's reasonable to conclude that the ending of QE3 won't really hurt gold. Also, considering that basically everyone has been expecting QE3 to end this October, this event is more than likely already priced in. Thus, in my opinion, the ending of QE3 is not going to be much of a factor in driving the price of gold lower. If gold does drop in the weeks and months after QE3, it will most likely be because of bad technicals, negative momentum, and good economic data.

There is one scenario in which the ending of QE3 might actually help gold go higher. That scenario would be if the general stock market falls as a result of no more QE. That could potentially help gold as funds get transferred away from stocks to other assets like commodities. During the interim period between QE1 and QE2, the Dow and S&P 500 went up slightly (about 2-3%), but they crashed after the end of QE2. In less than two months after the conclusion of QE2, the S&P 500 dropped about 15%. If something similar happens again with the general stock market, that could give gold a catalyst to go up. I'm not really betting on that, but this scenario shouldn't be discounted.

I should also mention that gold could get hurt by the ending of QE3 if the dollar strengthens because the U.S. is no longer printing money, while Japan continues its own QE program and the ECB begins their own version of QE. This could, as I said before, already be priced into the market, but gold investors should be careful about persistent dollar strength. The ECB is implementing a lightweight version of QE, but an intensifying of asset purchases down the road will likely stengthen the dollar even more.

Final Thoughts

At this point, I think gold could continue to be stuck in mud for the foreseeable future. There's really no near-term catalyst unless the stock market and economy tank, and the Fed has to initiate some kind of QE4. That's not happening this year and probably not in 2015 either.