ET Bureau

ET BureauThe sense of emptiness helps him “strategize”, he says. Though a frequent visitor to the US, Chhabria does not own a house there and prefers hiring chauffeur-driven cars. Left-hand-drives confuse him. For Chhabria — the businessman — this is the right time for strategizing. A lot is at stake. His company Allied Blenders and Distillers (ABD), which owns Officer’s Choice, the world’s largest selling whiskey brand by volume, has blueprinted an aggressive growth plan. It includes the buyout of a competing brand, acquisition of distilleries and bottling units, heavy borrowing to fuel this binge, and finally, a public issue of shares in two years.

Chhabria’s story is inevitably linked with that of two other men — United Spirits chairman Vijay Mallya and Chhabria’s elder brother, the late Manu Chhabria. The trio has over the last three decades joined hands and fallen out many times (see The Liquor Wars). Manu Chhabria passed away in 2002, and his family sold the liquor business to Mallya. Mallya has since handed over management control of his liquor business to Diageo and is struggling to hold on to his board seat and chairmanship. Only Kishore Chhabria, with Officer’s Choice, which accounts for 75% of ABD’s sales by volume, has the luxury to plan growth or take time off in never-heard-of towns in the US, which are almost cathartic for him.

Old-World Style

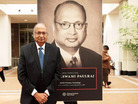

In India, Chhabria seems to have wrapped himself up in familiarity and tradition. Chhabria loves to be unconventional, in an industry where flamboyance is the convention. At home, which is Casa Grande on Little Gibbs Road, near south Mumbai’s Hanging Gardens, Chhabria prefers an old-world style. His office is in the same building as his residence, and he is surrounded by a group of old faithful and some anachronisms like CCTV cameras monitoring every room in the office with the monitor placed directly in front of his table. The office décor is anything but modern, and the drapes and chandeliers may even qualify as opulent.

“I have married only once. Bala (VR Balakrishnan), my secretary, was earlier my father’s secretary. My cook has been around for 36 years and my driver for 27 years. Once I grab hold of a person I rarely let go,” Chhabria says. Chhabria’s company ABD is the third largest maker of Indian-made foreign liquor (IMFL, the rather curious contraction used by governments to differentiate liquor made in the organised sector from indigenous hooch). An 8% market share in IMFL makes ABD one of the largest Indian-owned liquor businesses. The corporate office is at Lower Parel, in a spanking new building, where the company’s CEO Deepak Roy sits. Roy, an industry veteran who has also worked with Mallya in the past, has been allotted 5% sweat equity in the company by Chhabria, who owns the rest. Chhabria’s son-in-law Jeetu Hemdev, who is married to his elder daughter, works under Roy.

|

Chhabria confesses that he never encouraged either of his two daughters to take an interest in his business. “In hindsight, I can admit I was wrong. I thought liquor was not a good business for women,” he offers.

In business though, Chhabria has few mistakes to confess about. He has hardly taken a false step since he hired Roy in 2007. Roy has been busy taking the company into many new categories, launching two more premium variants of Officer’s Choice — Blue and Black. Roy expects OC Blue to sell 6 million cases by end-2014-15, almost a fourth of the flagship’s sales of 22.5 million cases. OC Black has been positioned to compete against Pernod Ricard’s best-selling Royal Stag whiskey. Roy’s efforts to ensure that ABD does not remain a one-trick pony include launching Jolly Rogers rum, Kyron brandy and a vodka named Wodka Gorbatschow.

Roy is also toying with the idea of launching OC Beer for younger consumers. ABD hopes to sell around 31-32 million cases this fiscal. ABD yet does not own a distillery. It buys alcohol. “A distillery is a strategic asset and, with ethanol blending with petrol, the alcohol cost is going up,” says Roy. So, one imperative is to buy a distillery and then add more bottling units to the ones ABD owns.

That calls for a Rs 1,200-crore investment to be financed via a bridge loan. It will be followed by a public issue of roughly Rs 500 crore in 2016, which will be used to retire some debt. Roy says with a little luck, he may catch up with Pernod Ricard India (which sold 29 million cases in 2013-14 and is estimated to sell 39 million cases in 2014-15), the Indian arm of the French company, within 18 months. But that is all volume growth. Pernod Ricard has changed the game in India by focusing on the premium segment. Therefore, though it sells about half as much as United Spirits, it is the value leader in spirits in India, say analysts. Even if ABD does succeed in overtaking Pernod Ricard in the number of cases sold, it may mean little to its profits. Though ABD is unlisted and its numbers for 2013-14 are not public yet, industry estimates peg its Ebitda (earnings before interest, taxes, depreciation and amortization) for last fiscal at Rs 90 crore on gross revenues of Rs 3,100 crore. In 2014-15, it is aiming at a 33% rise in revenues and a doubling of Ebitda.

Although United Spirits controls almost 40% of the Indian market (250 million cases) by volume, Pernod Ricard, by virtue of its premium play, controls more than half the value with 10% of volumes. Industry sources suggest that on an average Pernod Ricard’s margins per case are three times those of United Spirits due to its focus on the premium segment.

Motilal Oswal analysts Manish Poddar and Gautam Duggad recently said they expect ABD to launch a new brand for the premium segment by the end of this financial year. The analysts add: “However the success rate in premium product launches is very low, with material investment requirements (average annual spend of Rs 25 crore to build a premium brand). In spite of the costs, the premium segments show greater potential today with Scotches showing a 17% growth in 2013-14 and premium rum growing at 33%. In comparison, the two lowest rungs of whiskey —economy and regular — have de-grown.”

The Chhabria Imprimatur

And he isn’t. Note his recent moves to buy out Tilaknagar Industries whose mainstay is the Mansion House brandy label, the second highest selling brandy in India. Tilaknagar is locked in litigation with Dutch company Herman Jansen, the original owners of the Mansion House brand. Chhabria had engaged with the owners of Tilaknagar for almost a year, exploring a buyout. However, after a year’s talks went nowhere, Chhabria’s ABD bought 50% rights to the brand from Herman Jansen and become a party to the dispute.

Chhabria explains: “This move is more to block someone else from buying it. The litigation will take some time. I did not want anyone else to grab the brand.” Chhabria knows what he is talking about. He himself had developed Officer’s Choice within Shaw Wallace while working for his brother Manu and managed to leave that company with the brand in tow. Again, he managed to keep Officer’s Choice for himself when he extricated himself from Herbertsons, where he was a partner with Mallya; in 2004, a decade after they came together, Chhabria and Mallya parted ways, but the former not without the brand he had built. So, when Roy says ABD could overtake Pernod Ricard by volume in the next 18 months, Chhabria does not sound very enthused. He is keen to stress that the tag of the only one surviving among liquor barons in India hardly means much. “We are god-fearing men in this company. We do not want to ride tigers,” Chhabria says. “We want to aspire but not for the number one slot.”

Perhaps, there is realization that the two number one slots, one by volume and the other by value, are both entrenched with United Spirits-Diageo and Pernod Ricard respectively; and their marketing and financial muscle will be something difficult to match. But on one of those rides on American roads if Chhabria had to sit back and contemplate his journey over the past three decades, he would not be too dissatisfied with his current position. "God has been kind," he adds.

Get Unlimited Access to The Economic Times

Get Unlimited Access to The Economic Times