Yahoo investors could reap $11 bn in breakup

Yahoo, now worth less than those Asian stakes, has put $1.3 billion toward takeovers since 2012, around the same time Mayer took the helm.

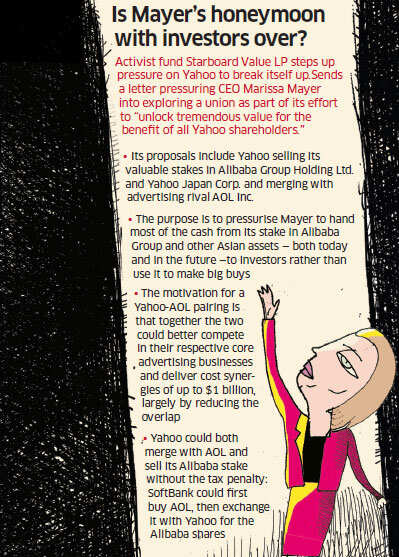

NEW YORK: Yahoo! Inc. shareholders are inching closer to a potential $11 billion windfall.Activist fund Starboard Value LP stepped up pressure on Yahoo last week to break itself up, a move analysts say could amount to an $11 billion market value gain.

NEW YORK: Yahoo! Inc. shareholders are inching closer to a potential $11 billion windfall.Activist fund Starboard Value LP stepped up pressure on Yahoo last week to break itself up, a move analysts say could amount to an $11 billion market value gain.Starboard’s proposals include Yahoo selling its valuable stakes in Alibaba Group Holding Ltd. and Yahoo Japan Corp. and merging with advertising rival AOL Inc. The ideas lay out a plan for rewarding investors who are losing confidence in Chief Executive Officer Marissa Mayer’s ability to create value with the acquisitions she’s been making.

Yahoo, now worth less than those Asian stakes, has put $1.3 billion toward takeovers since 2012, around the same time Mayer took the helm, according to Starboard. During that period, earnings before interest, taxes, depreciation and amortization dropped by almost half as revenue also slid.

Investors are now left holding a $40.52 stock that could be valued at more than $50 in a breakup -- $51 if you ask Gabelli & Co. and up to $57 by Albert Fried & Co.’s estimates. “This is a very classic sum-of-theparts story: If you can break up the company into its different parts, it would be worth a lot more,” Brett Harriss, an analyst for Gabelli, said in a phone interview.

Yahoo could also be a good acquisition for Alibaba or SoftBank, Harriss said. A deal would enable Alibaba to buy back its shares from Yahoo without a large tax leak. As SoftBank searches for targets, buying Yahoo would increase its stakes in Yahoo Japan and Alibaba.

|

STARBOARD RECORD

In past investments such as Office Depot Inc. and TriQuint Semiconductor Inc., Starboard’s exhaustive research and activism have helped yield gains for shareholders. The activist is now targeting a company whose business investors assign no value. Yahoo shares are instead buoyed by the stakes in Alibaba and Yahoo Japan, which add up to more than Yahoo’s closing price yesterday of $40.52. Investors are awaiting the potential payoff from selling those assets, rather than expressing bullishness on Yahoo itself.

With the hype over Alibaba’s initial public offering dying down, bears are beginning to pile in to Yahoo. “Now that Alibaba’s IPO is in the rearview mirror, Yahoo’s no longer benefiting from Alibaba’s `What if ’ valuation questions,” Youssef Squali, a New York-based analyst at Cantor Fitzgerald LP, said in a note on MOnday. “Marissa Mayer’s honeymoon with investors is over.”

LOOKING FOR CASH

While Mayer has focused on making purchases to try to position the Web portal for future growth, shareholders would prefer to see the company’s cash returned to them, said Sameet Sinha, a San Franciscobased analyst at B. Riley & Co. “You have an activist investor saying `You have this cash and we just want to make sure that you will utilize it responsibly, versus the last couple of years where you’ve made a lot of acquisitions that we haven’t seen bear any fruit,’” Sinha said in a phone interview. Yahoo’s trailing 12-month Ebitda was about $1.8 billion in the period before Mayer took over and embarked upon a takeover spree, according to data compiled by Bloomberg. It has since fallen to $948 million. Revenue declined about 7% in that same span.

Analysts have described many ways Yahoo can reward investors, though most say that a tax-efficient method for exiting the Asian stakes takes priority. Yahoo retained a 16.3% interest in Alibaba after the Chinese e-commerce company’s IPO earlier this month. Selling its remaining shares would create a large tax bill, which could be avoided if Alibaba took over Yahoo, shareholder Ironfire Capital LLC has suggested.

Yahoo is also the second-largest owner of Yahoo Japan behind SoftBank, which means SoftBank could use an acquisition as a way to gain more control of the Japanese business. SoftBank has had internal conversations about buying Yahoo, according to a person familiar with the matter, who asked not to be identified discussing private information.

Starboard is proposing that AOL, which has reinvented itself as a competitor in the digital-advertising industry, merge with Yahoo to save as much as $1 billion of expenses. Not only would there be cost-cutting opportunities,.

ASSET SWAP

B. Riley’s Sinha says there’s a way for Yahoo to both merge with AOL and sell its Alibaba stake without the tax penalty: SoftBank could first buy AOL, then exchange it with Yahoo for the Alibaba shares. He also estimates Yahoo could add about $15 to its stock price by raising money domestically and then giving it to shareholders, rather than paying them with the repatriated proceeds from the Asian assets.

COMMENTS

All Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

PostFind this Comment Offensive?

Choose your reason below and click on the submit button. This will alert our moderators to take actions