Removing the 'double Irish' won't kill tech jobs

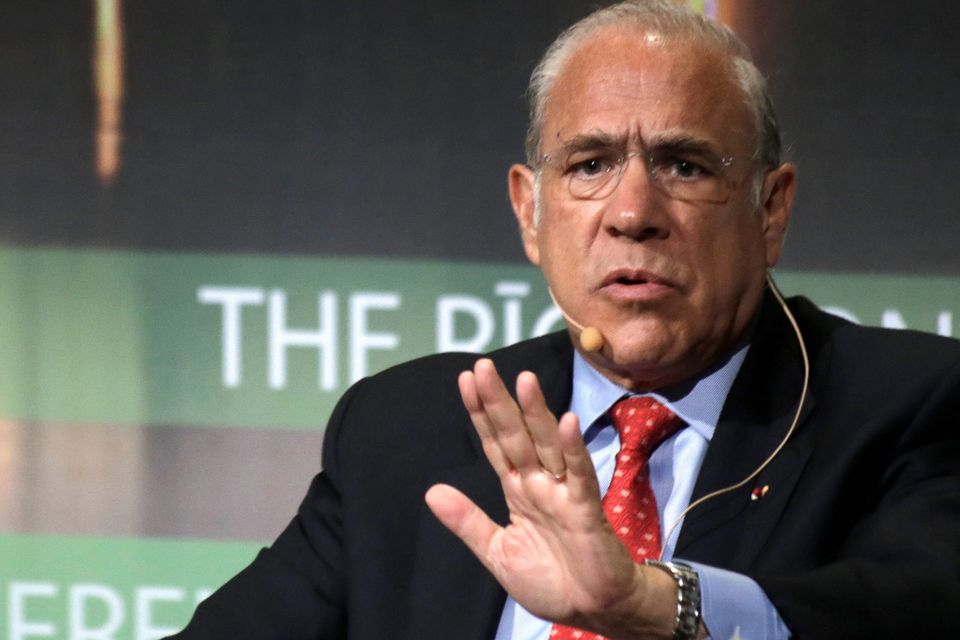

Secretary-General of the OECD Angel Gurria

Pack your bags for California, tech workers: the OECD's new proposed clampdown on the 'double Irish' tax avoidance loophole looks set to cost you your job here.

Or will it? Are tech jobs here genuinely linked to a couple of high-profile accountancy tricks? It seems unlikely, for two reasons.

1. Which jobs, exactly, are at risk?

OK, so KPMG, PwC, Matheson and others might see their brass plate consultancy division slimmed out a little. But which multinational tech jobs are really in the firing line? Apple's 4,000 in Cork? Google's 2,300 in Dublin? Microsoft's 1,200? Facebook's 650? LinkedIn's 500? Twitter's 200? The thousands in smaller companies around Dublin's Silicon Docks?

A closer look at how these companies are set up here casts doubt on doomsayers' initial reactions.

It is true that Apple and Google both take advantage of extreme tax avoidance using an Irish office. But that has become largely (though not exclusively) separate to those companies' substantive operations here. In other words, the brass-plate element of their existence here has become separate to what those companies' jobs depend on. (Apple runs marketing, support, logistics and other things from Cork; Google runs ad support and other functions from Dublin.)

So in any post-facto 'double-Irish' environment, why exactly would they move these facilities to London, Berlin or other European centres? Skilled labour? Unlikely. Contrary to what is sometimes reported, there is not much less of a skills shortage in London or Berlin than there is in Dublin.

Tax rate? Nope: Ireland's 12.5pc - which is not threatened in any way by these OECD proposals - is at the lower end of anything available around Europe.

So why would they move? Even the weather is no longer used as an excuse, with so many newer incoming tech firms here coming from the chilly, foggy, rainy Pacific northwest of the US.

But perhaps it is the incoming tech jobs that could be at risk? The procession of 20 and 30 jobs announced each week in Dublin's Silicon Docks?

That seems unlikely too. Many of these firms are young and, while well funded and taking in some revenue, don't yet make a profit. So the issue of tax (which is paid on profits) doesn't yet arise. This reality was explained to me a few months back by the founder of Nitro, a booming Australian start-up which came to Dublin a year ago and whose office here is growing quickly.

"Tax first, talent second is a narrative I'm reading in Irish newspapers," Sam Chandler told me.

"But for a company our size, I swear to you it's the other way around. You have to look at it from the point of view of a company our size, which is $25m (€18.6m) in annual revenue. We're not really big enough to benefit from any fancy tax-planning.

"Honestly, we're still trying to create products and get the right people. We're nowhere near the stage of being at a revenue and profit level where Apple-style tax planning is a major issue.

"A tax rate might be appealing in the long run, but not at our stage. The only thing we're interested in is getting the right people and building the right product. That means sales, engineering and executive leadership. It really does."

Other small to mid-sized technology firms say the same thing. Getting rid of a 'double Irish' tax avoidance mechanism looks very unlikely to deter such firms from locating here.

2. The Americans could still scupper it

Conventional wisdom suggests that the OECD's tax clampdown will only work if the US, the origin of most of the multinationals affected by it, goes along with it. And many in the US - such as President Obama and his Democratic Party - have enthusiastically supported it. But some of America's senior law-makers are sceptical to the point of being obstructive. Republican Senator Orrin Hatch, who leads the US Senate's powerful Finance Committee, has previously poured scorn on the initiative as "a way for other countries to simply increase taxes on American taxpayers". This is important as the Republicans appear set to retake overall majority of the Senate in the November mid-term elections.

Last week, Hatch ramped up his pro-multinational rhetoric. "At virtually every turn, the calls for economic patriotism have been tied to support for legislation that would make it more difficult for corporations," he said. "The specific proposals the administration has endorsed are punitive and retroactive. They are not designed to improve the business climate in the US. Instead, they are intended to build walls around American corporations."

Hatch was referring specifically to proposals aimed at reforming so-called "tax inversion", a different issue but targeting the same corporate tax avoidance themes. If the OECD was some sort of international judicial, regulatory or quasi-legal entity, the objections of Hatch or the US Senate to reform might not be such a roadblock. But the OECD is none of these things. It's a think-tank. It measures trends and issues recommendations. Governments sometimes pay attention to it and sometimes don't.

Join the Irish Independent WhatsApp channel

Stay up to date with all the latest news