Diwali begins early as Indian OEMs' sales light up in August

Good news spreads fast and the ‘acche din’ mantra seems to be making its way to the Indian auto sector.

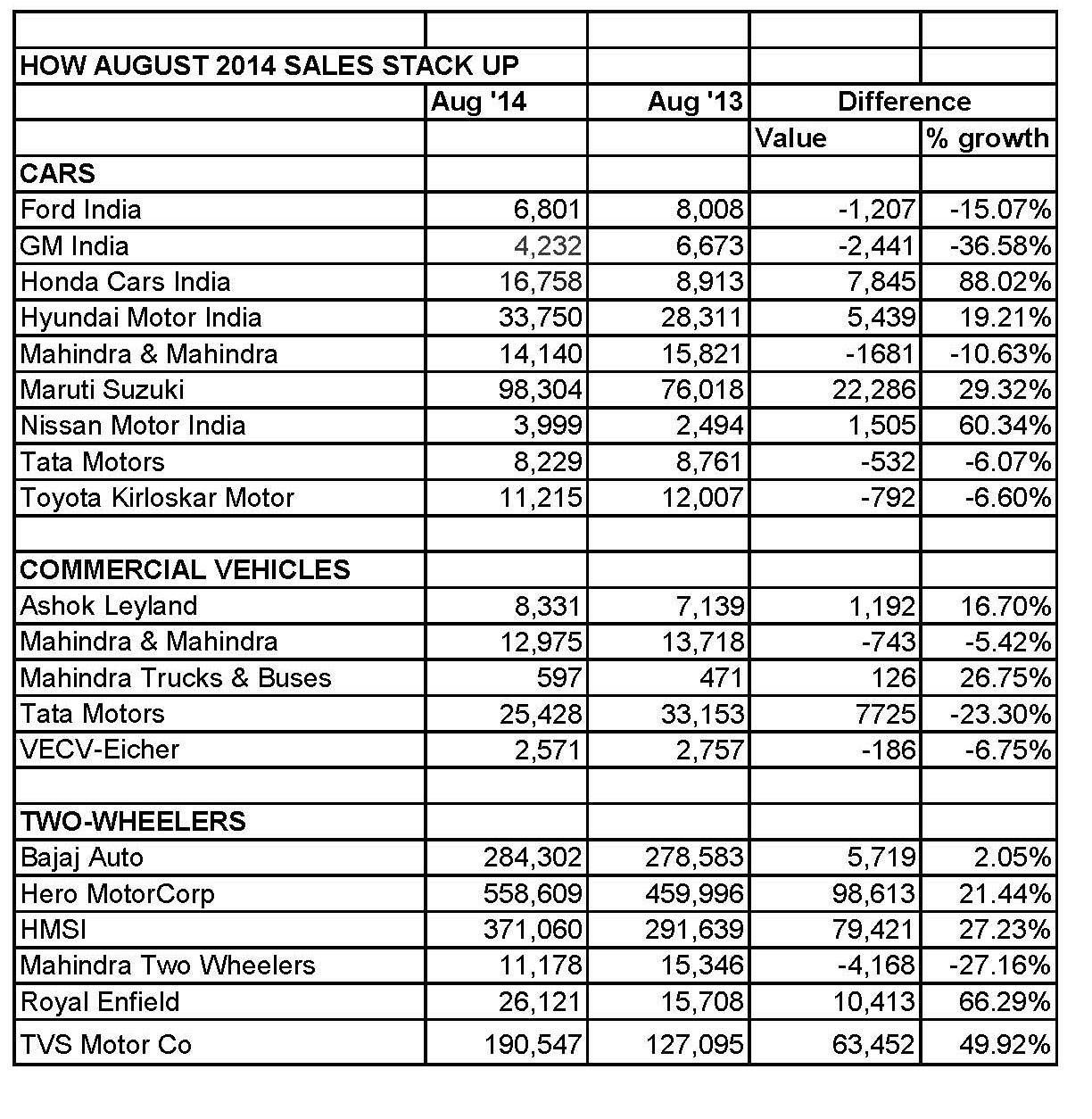

Good news spreads fast and the ‘acche din’ mantra seems to be making its way to the Indian auto sector. For the fourth month in a row, passenger car sales rose on the back of improved market and economic sentiment, and increased footfalls in showrooms across the country. And, with the opening of the festive season starting with Raksha Bandhan and the ongoing Ganesh Chaturthi, things can only get better. With sales lighting up for most carmakers, Diwali could have begun for the Indian automobile sector. Importantly, medium and heavy commercial vehicle (M&HCV) sales, which have faced the brunt of the slowdown over more than two years, have seen double- digit growth, the first indication of economic revival.

Furthermore, the Indian economy has registered a growth of 5.7 percent between April-June 2014 compared to the year-ago period, indicative of a slow revival underway in the country. The growth has been driven by the manufacturing and services sectors, slowing inflation and now drives hopes of sustainable expansion thanks to the Narendra Modi-led government's focused efforts to give a fillip to the manufacturing sector, among other growth-inducting initiatives.

Even as Maruti Suzuki India and Hyundai Motor India, the top two carmakers, revealed their double-digit sales growth in August 2014, it is clear that the passenger vehicle sector is headed for a turnaround. For 2013-14, the overall passenger vehicle sector posted a decline of 6.05 percent (passenger cars: -4.65 percent / UVs: -5.01 percent / vans: -19.58 percent).

Maruti Suzuki India, the country’s largest carmaker, has reported a 29.3 percent increase in its domestic sales in August 2014, selling a total of 98,304 units (August 2013: 76,018). The push has come from sales of the quartet of compact cars (Swift, Ritz, Celerio and Dzire) which rose 53.2 percent to 46,759 units (August 2013: 30,512). Maruti also sold 1,328 units of the Dzire Tour, the original Dzire that is now sold only to fleet operators. While the entry level duo of the Alto and Wagon R sold 34,686 units last month (August 2013: 32,019) to record an 8.3 percent increase, sales of the SX4 sedan, which is soon to be replaced by the upcoming Ciaz, was down 85 percent and sold only 50 units last month. The popular Ertiga continues to impress and comprised the bulk of the 5,491 units sold in August. Interestingly, the Omni and Eeco vans sold nearly 10,000 units in August 2014, up 25.6 percent over sales a year ago.

Hyundai Motor India Ltd (HMIL), the country’s second largest car manufacturer, saw its August 2014 sales rise 19.21 percent to 33,750 units (August 2013: 28,311). Rakesh Srivastava, senior VP (Sales and Marketing), HMIL, said that a good market response to new cars like the Elite i20, Xcent and the Grand has provided the sales momentum. “We maintain a cautious optimism for a good festive season on the strength of new products, increase in demand for petrol cars and improving customer sentiments,” he added.

Honda Cars India recorded domestic sales of 16,758 units in August 2014, up 88 percent (August 2013: 8,913). Sales were powered by the Amaze sedan that totted up 9,198 units, over 50 percent of the tally, while the Mobilio MPV saw sales of 5,530 units. The MPV – Honda’s first in India – has got over 10,000 bookings.

The City sold just 757 units but that’s because production had been stopped at Greater Noida as Honda shifts production to its Tapukara, Rajasthan facility. Production of the City resumes this month. Meanwhile, the Brio hatchback sold 1,211 units and the CR-V, 62.

Honda sales were up 49 percent for April-August 2014 with 73,185 units as against 49,263 units during the corresponding period last year. According to Jnaneswar Sen, senior VP (marketing & sales), "We are geared up for strong sales in the coming months."

Mahindra & Mahindra’s passenger vehicles segment (which includes UVs and the Verito cars) sold 14,140 units, down 10.63 percent (August 2013 : 15,821). The company’s overall sales, comprising trucks, buses and three- and four-wheeler commercial vehicles, were down 6 percent year on year to 33,145 units (August 2013 : 35,159). Commenting on the sales, Pravin Shah, chief executive, Automotive Division & International Operations, said : "In spite of our overall sales remaining flat in August, we continue to be optimistic due to the industry’s enhanced business confidence reflected by signs of revival in manufacturing.”

Tata Motors, which is banking on the Zest sedan to give a new verve to sales, sold a total of 8,229 cars last month, down 6.07 percent (August 2013: 8,761). Sales of utility vehicles comprised 2,746 units, down by 2 percent over the 2,803 UVs sold in August. While cumulative sales of passenger cars this fiscal for Tata Motors is 33,450 units, a 25 percent decline year on year, cumulative UV sales at 11,274 units is a 7 percent fall.

Meanwhile it is learnt that the Zest has received over 10,000 bookings since the company started taking orders on July 19, prior to the car’s launch on August 12. Ranjit Yadav, president of the passenger vehicle business unit, tweeted saying the car has received 10,000-plus orders for the next two months.

Ford India’s domestic sales were 6,801 units, down 15 percent (August 2013: 8,008), 70 percent of them being EcoSports. “We anticipate a continued revival in customer sentiments as we lead up to the festive season and are prepared to meet the higher demand for our cars, including the EcoSport,” said Vinay Piparsania, executive director, marketing, sales and service, Ford India.

Ford India is considering starting a third shift for the EcoSport which crossed the 100,000 unit mark in combined domestic wholesale and export sales. The company said it has significantly reduced the waiting period for most variants of the EcoSport. In a recent interview to Autocar India, Nigel Harris, president, Ford India, said, “The EcoSport has done well not only in India but in every market, and that puts pressure on supplies. We have worked on the supply base and have got to a point now where we can build more. We are now going to move to a third shift.”

General Motors India reported a 36.58 percent decline in August sales at 4,232 units (August 2013: 6,673. The August numbers included 1,305 units of the Chevrolet Beat, 1,283 units of the Tavera and 688 units of the Enjoy MPV. GM India’s vice-president, P Balendran said: “There is some positive movement in the market because of new entries. However, the buoyancy is still missing and we expect the market to improve only during the festival season.”

Nissan Motor India reported domestic sales 3,999 vehicles in August 2014, an increase of 60.3 percent compared to the 2,494 units sold a year earlier.

Toyota Kirloskar Motor reported sales of 11,215 units in August 2014, down 6.59 per cent as compared to 12,007 units in August 2013.

M&HCV SALES FINALLY MOVE UP

Sales of medium and heavy commercial vehicles (M&HCV) have seen double-digit growth in August 2014, perhaps the first indication of an economic uptick. Tata Motors recorded double-digit growth in the M&HCV segment after consistent decline. Ashok Leyland and Mahindra Trucks and Buses also saw an increase in their sales. These numbers may indicate that the CV sector in India is recovering after almost bottoming out.

In absolute numbers, Tata Motors’ overall sales (both heavy and light) slid 23 percent largely due to the prolonged slump in the LCV demand. It sold a total of 25,428 units (August 2013: 33,153 units).

Tata’s LCV numbers dropped by 35 percent – 16,287 units as against 24,904 units in July 2013. However, in a significant sign of positivity, M&HCV sales saw growth of 11 percent selling 9,141 units compared to 8,249 units a year ago.

Ashok Leyland posted an overall growth of 17 percent, with its M&HCVs selling 5,830 units, a strong growth of 18 percent (August 2013: 4,939). Its LCV sales recorded a 14 percent increase to 2,501 units (August 2013: 2,200).

VE Commercial Vehicles posted a sales decline of 6.9 percent in the domestic market in the 5-tonne and above category, selling 2,571 units (August 2013: 2,757).

Meanwhile, Mahindra Trucks and Buses recorded impressive growth of 27 percent, selling 597 units against 471 (August 2013: 471).

TWO-WHEELER OEMS POST ROBUST SALES

Hero MotoCorp (HMCL), the largest two wheeler maker in the world by volumes, has reported sales of 558,609 units during August 2014, up by a healthy 21.44 percent (August 2013: 459,996). Setting up a platform to notch sales during the festive months of September and October, the company has lined up at least three new products to be launched soon. It is evident that the company is targeting sales of more than 1.2 million two- wheeler over the next two months, and is accordingly preparing the stock to address the anticipated demand.

According to the company, its latest products – new Karizma, ZMR Xtreme, Passion Pro TR and the new Pleasure scooter – have been well received in the market. A statement from Hero MotoCorp mentions that while the Splendor iSmart continues to drive volumes in the market, another Splendor variant, the Splendor Pro Classic will be rolled out in the coming weeks across all dealerships.

Meanwhile, marking a healthy growth of 27.23 percent in August sales, Honda Motorcycle & Scooter India (HMSI) has registered total sales of 371,060 units (August 2013: 291,639). Its scooter sales at 217,866 units saw a spike of 47.61 percent (August 2013: 147,600 units), but HMSI’s motorcycle sales marked a rather flat growth of 6.35 percent during the month – 153,194 bikes (August 2013: 144,039 units).

HMSI, which is pinning substantial hopes on motorcycle sales during this fiscal, is all set to roll out the all-new 160cc premium commuter bike around the festive season. All eyes would now be on the upcoming product, which is expected to add some zing to its motorcycle portfolio.

Bajaj Auto reported total motorcycle sales of 284,302 units during August 2014, as against 278,583 units sold in August last year (both numbers include export figures as well). This marks a flat growth of 2.05 percent. According to the company, the Discover brand of bikes has shown a growth of 16 percent year-on-year, by raking total sales of 93,000 units during the month. The company is looking forward to launch the faired versions of the performance oriented KTM 200 and 390 bikes, the KTM RC200 and RC390 in the coming week.

Witnessing a strong surge in August 2014 sales, TVS Motor Company sold a total of 190,547 units over the sales of 127,095 units in August 2013. This represents a substantial growth of 49.92 percent for the strong R&D-backed company. The strong numbers can be attributed to rising scooter sales, which grew by 84 percent, increasing from 36,478 units in August 2013 to 67,240 units in August 2014 (including exports). Motorcycles, on the other hand, reported a growth of 36 percent by selling 83,332 units in August 2014 over the sales of 61,313 units in August 2013 (including exports).

Continuing to register handsome growth, Royal Enfield too has reported domestic sales of 26,121 units for the month, up by 66 percent over 15,708 units sold during August 2013.

RELATED ARTICLES

Uniproducts India targets 15% growth till FY2027, eyes new EV OEMs for NVH parts

The Noida-headquartered company, which is a leading manufacturer of roof liners, floor carpets, sound insulation materia...

Ford to build more EV software capability at Chennai tech hub

Ford Business Solutions India, which currently employs 12,000 personnel set to add 3,000 more; Ford, which is known to b...

ASK Automotive to set up JV with Aisin to sell aftermarket parts for cars

Ask Automotive will have 51% of the equity of the joint venture to be set up with Aisin Asia (Thailand) Company and Aisi...

By Autocar Pro News Desk

By Autocar Pro News Desk

01 Sep 2014

01 Sep 2014

3660 Views

3660 Views