Chart of the Day: Here's how bad business dragged down loans this year

Deposits also remained paltry.

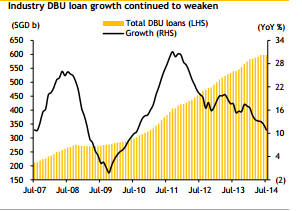

Industry domestic banking unit (DBU) loan growth slowed to 10.8% YoY in July, on

slowing business (+14.1%) and housing loan growth (+7.0%).

In a report by Maybank Kim Eng, it was revealed that lending for general commerce (+18.8% YoY) and to financial institutions (+23.4%) continued to anchor DBU loans.

Property weakness continued to drag down consumer loan growth (+6.0% YoY), to its

slowest in seven years.

Maybank KE adds that the domestic loan-growth slowdown may manifest itself in Singapore banks’ loan data for 3Q14. However, the impact should be cushioned by stronger loan demand from Greater China, which has been gaining in importance.

Here’s more from Maybank KE:

SGD deposits rose just 0.7% MoM or 0.1% YoY in July. Holding cash remains unappealing when interest rates are so depressed. As a result, SGD LDR continued to hover around to 86.5%, a level we are still comfortable with. But with deposit growth expected to remain sluggish, SGD LDR could rise further.

Advertise

Advertise