Highlights of the Prior Week

Macro

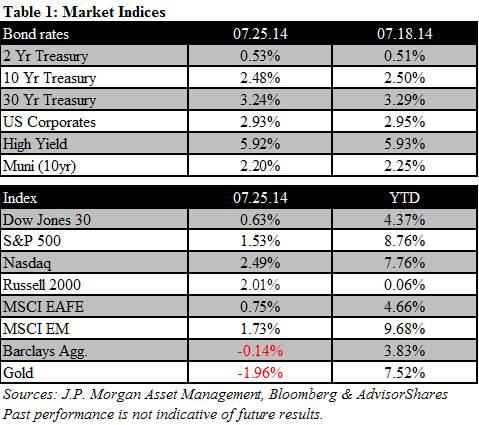

In our report last week we had a lot of interesting and potentially scary events to consider but for this week's report we have very little to recap. Sure, Amazon (NASDAQ: AMZN) dropped 9.65% after its quarterly report was viewed as a let down but for the week the S&P 500 only moved 1/10 of one point. The Dow 30 had a bigger move dropping 0.80% for the week with much of that decline attributable to Visa's (NYSE: V) 3.6% earnings related decline on Friday but the NASDAQ was able to gain 0.40% despite some carnage in the semiconductor space.

A few weeks ago we noted that Philadelphia Semiconductor Index was dramatically outperforming the indexes which is normal market behavior early on in the cycle and regardless of what anyone thinks comes next for equities, after 64 months of going up we are certainly not early in the cycle. The loudest decline in the group came from Xilinx (NASDAQ: XLNX) which fell 13% after its earning report which included weak guidance which caused sympathetic declines in many other chip stocks.

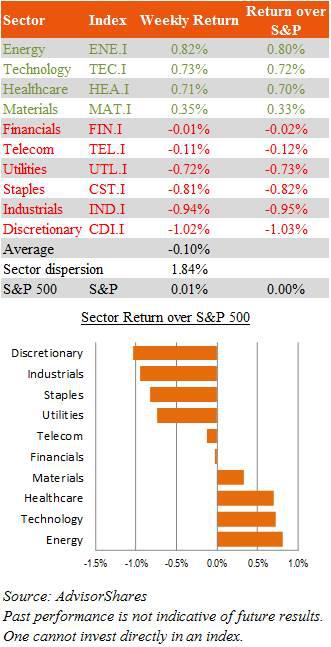

At the sector level there were some big movers despite the S&P 500 being flat. Tech (semiconductors notwithstanding), energy and healthcare were all up 70-80 basis points while utilities, staples and industrials dropped a similar amount but the week's biggest loser was discretionary which fell 102 basis points.

The yield on the ten year US Treasury Note continues to spend most of its time below 2.5%, closing at 2.46% on Friday. The CBOE Volatility Index moved back above 12 after a 7% rally on Friday but obviously remains very low relative to its own history. August Gold Futures closed the week down 0.27% despite rallying $17 on Friday.

Factset had interesting data for the current earnings season. Through July 25 230 S&P 500 components had reported earnings. Of that number 76% had beaten their respective earnings estimates while 67% had beat on revenue estimates. Thirty two companies gave negative outlooks for future earnings reports and 15 gave positive guidance. Based on Factset's analysis the forward PE ratio for the S&P 500 now sits at 15.6.

Trying to draw a forward looking conclusion based on PE ratios is tricky because historically the market has been able to stay at high or low valuations for years. The 15.6 cited by Factset is not problematic but the CAPE ratio (Cyclically Adjusted PE ratio) derived by Robert Shiller is relatively high at 26.16. For some context it got as high at 45 as the tech bubble was cresting in 2000 before popping.

The new week started with a couple of big mergers. Zillow (NASDAQ: Z) is seeking to buy Trulia (NYSE:TRLA) for $3.5 billion and Dollar Tree (NASDAQ: DLTR) is buying Family Dollar (NYSE: FDO) for $8.5 billion. As of this writing there is no news on what the merged companies would be called but it is unlikely that the DLTR and FDO merger will result in the stores being called Dollar Dollar.

ETF News & Data

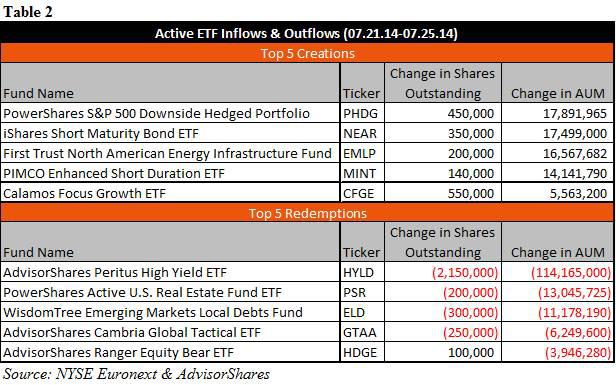

The Wall Street Journal ran an article called Investors Retreat From Junk Bonds which notes that in the last month $2.38 billion have flowed out of high yield funds which is the most for any week since June 2013. The week before last, $1.68 flowed out of the space. Although the flows discussed in the article are for traditional mutual funds the rotation that appears to be underway is noteworthy.

There were only two new ETFs last week; one fund focusing on small and mid cap Chinese stocks from Market Vectors and First Trust launched a fund of funds comprised of international equity ETFs.

Interesting Reads

Scientific American reported something that all people with more than one dog already know; their four legged companions experience jealousy. And again while this is not news to dog owners, scientists say that dogs experience jealousy because it turns out to not be a complex emotion.

As a bonus interesting read is this photo essay taken from rooftops in Hong Kong. While the pictures are amazing, people with acrophobia may not enjoy link.

Sports

The Tour de France was completed on Sunday and won by Italian cyclist Vincenzo Nibali from Team Astana. While only the most diehard cycling fans will know the name his victory makes him only the sixth cyclist to win all three grand tours (Tour de France, Vuelta a Espana and Giro d'italia). The other five to do so were Alberto Contador, Bernard Hinault, Eddy Merckx, Felice Gimondi and Jacques Anquetil.

Roger Nusbaum, AdvisorShares ETF Strategist

Source:Google Finance, Yahoo Finance, Wall Street Journal, XTF.com, ontheroofs.com, Scientific American, factset.com, multpl.com

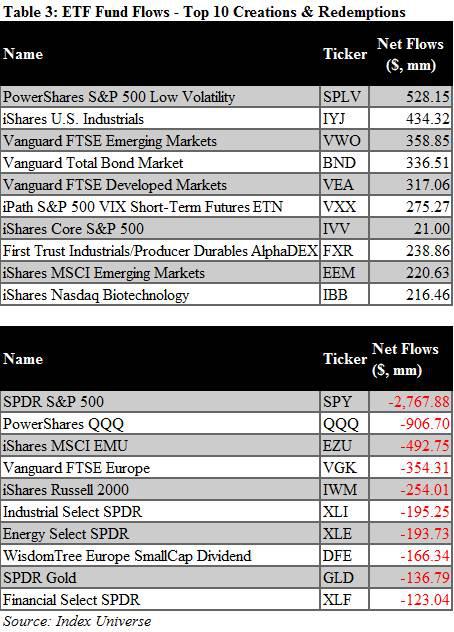

Weekly ETF Flows

Weekly ETF FlowsFor July 21, 2014 to July 25, 2014

Shares outstanding include totals as of current day NAV.

S&P Sector Analysis

S&P Sector AnalysisAs for the sectors of the S&P 500, four outperformed the broad benchmark - Energy, Technology, Healthcare and Materials. The remaining six - Financial, Telecom, Utilities, Staples, Industrials and Discretionary- each underperformed. The dispersion between the top-performing and bottom-performing sectors was roughly 1.84% this week, with Energy outperforming all, and Discretionary coming in last.

For July 21, 2014 to July 25, 2014

Sector performances, as measured by the S&P 500 sector indices were:

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.