By Carl Dahlman Will living standards in emerging-market economies and developing countries continue to catch up with advanced economies in the years to come?

Will living standards in emerging-market economies and developing countries continue to catch up with advanced economies in the years to come?

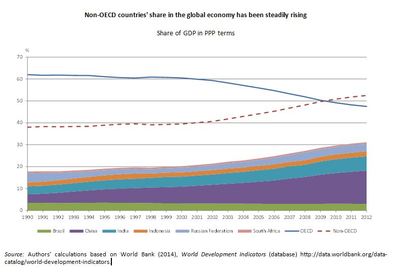

The shifting balance of the economic growth from West to East -- the so called "shifting wealth" phenomenon -- and an increasing global interdependence have been important in gradually closing the gap. In 2010, the share of global GDP of non-OECD countries surpassed that of OECD countries. This trend is led by the BRIICS (Brazil, the Russian Federation, India, Indonesia, China and South Africa) who together account for nearly 60% of the share of developing and emerging countries in global GDP.

Despite this increasing share of global GPP, however, many emerging economies -- including Brazil, South Africa, India and Indonesia-- will not reach OECD per capita incomes by 2050 if they continue growing at the average rates seen during 2000-2012. Worse still, there has been a significant slowdown in the rate of growth of emerging-market economies more recently, including in China and the rest of the BRIICS.

The OECD Development Cente's Perspectives on Global Development shows there are many reasons for this slowdown: depressed demand for imports by OECD economies from the weak recovery from the 2008/9 economic crisis; the fall in commodity prices that have been driven up by high Chinese growth; and concerns that historically low cost of capital will begin to rise to more normal levels as OECD countries recover.

The ability of these countries to close the gap in living standards depends on the global context including the slowdown in the growth of BRIICS, and of China in particular. It also depends on individual country strategies. Growth slowdowns are often related to slowdowns in productivity growth, and in the medium and long run only productivity increases will ensure long term growth.

In middle-income economies, including in the BRIICS, productivity levels are still very low when compared to those of advanced countries (Figure). There are many ways to improve productivity to boost growth. For countries in earlier stages of development, these include shifting labor from low to higher productivity activities, and using capital and labor more intensively. Brazil and South Africa, in particular, could still increase their pace of capital accumulation; while China needs to improve investment efficiency.

On the labor side, India and South Africa need to boost the creation of productive employment. Their labor force participation rates have been decreasing over the last decade, from already low levels. A failure to reap the "demographic dividend" in these countries would mean a major drag on their economies or even worse, social tensions and instability.

Another challenge for productivity improvement is that the commodity boom fuelled by demand from China and India --which together now account for almost one quarter of global raw material imports-- has meant that many of these countries have specialized in natural resource-based exports. While this presents an opportunity to exploit domestic resources, it can also make the development of skills more difficult and lessen the flexibility of the economy to move into higher value areas and the potential for growth in new sectors.

The answer lies in making greater efforts to diversify economic structures towards higher value activities. To do so, countries must increase the education and skill levels of their workforce; improve their capacity to innovate by importing new ways of producing and distributing goods and services; and develop a greater competitive edge in international markets. Beyond tapping global knowledge through imports of capital goods, technology licensing and foreign tertiary education, China has made steady progress in becoming more innovative on its own by significantly investing in R&D, becoming the second largest R&D spender in the world.

Although exports of ICT-enabled services in India supported growth over the last decade, productivity in these services is still lagging far behind the levels of those in advanced countries. This is true for all BRIICS. Likewise, advancing better regulation and competition policies, improving capital and labor markets, and facilitating a more effective integration into global value chains, are all needed to enable a smooth path towards a higher value economy. Brazil's GDP share of exports and imports, for example, are around 10% lower than the shares of all other BRIICS countries, highlighting that the country could still be better integrated in the global economy.

Development goes far beyond just economic growth, however. It needs to be both inclusive and sustainable. Income inequality has increased in all of the BRIICS except in Brazil and, more recently, the Russian Federation. On the other hand, Brazil and the Russian Federation -- like all BRIICS -- face social tensions with major demonstrations stemming from a rising of a "middle class" that demands better services from their governments. BRIICS countries also face challenges concerning environmental degradation, particularly in China where rapid industrialization has taken an immense toll on the environment.

The ability of developing countries to further converge with OECD living standards depends not only on the changing global context, but on individual countries' strategies. Ultimately, the most effective combination of policies to reach the goal of inclusive and sustainable growth will depend on the specific needs of each country, as well as the capability of their governments to develop and implement new and tailored strategies.

Carl Dahlman is Head of Global Research at the OECD Development Center.