- News

- Business News

- India Business News

- Young entrepreneurs turn angels for younger startups

Trending

This story is from June 30, 2014

Young entrepreneurs turn angels for younger startups

After creating billion-dollar startups, India's first generation e-commerce & mobile entrepreneurs have donned a new hat — that of angel investors. Despite steering high-growth companies themselves, these 30-somethings are using their personal wealth and time to push a whole new bunch of younger ventures.

MUMBAI: After creating billion-dollar startups, India's first generation e-commerce & mobile entrepreneurs have donned a new hat — that of angel investors. Despite steering high-growth companies themselves, these 30-somethings are using their personal wealth and time to push a whole new bunch of younger ventures.

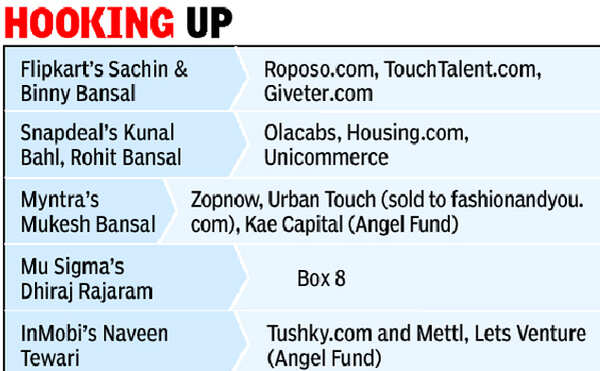

India saw the first wave of entrepreneur angels when the likes of Makemytrip's Deep Kalra and Naukri.com founder Sanjeev Bikhchandani took their companies public.However, this time around most of the angel investing is being done by existing entrepreneurs who are in the thick of running their own businesses. Whether it's Sachin and Binny Bansal of Flipkart, Snapdeal's founders Kunal Bahl and Rohit Bansal, Mu Sigma's Dhiraj Rajaram or InMobi's Naveen Tewari, they are all keenly investing in new ideas — a sign of the overall startup ecosystem maturing in the country along the lines of Silicon Valley.

Angel investing is typically done at a very early stage of a company's life, and startups say they gain significantly from these entrepreneur angels. "Who better to know the high potential and market opportunities than existing entrepreneurs? This is great for the ecosystem. It also highlights the fact that this new breed of young entrepreneurs is truly putting its money where its mouth is. I find this very exciting for the future of value creation in the Indian market," says one-time entrepreneur Avnish Bajaj, MD at VC fund Matrix Partners India. Bajaj, along with his Harvard Business School classmate Suvir Sujan, founded India's largest online auction site Baazee, which was later acquired by eBay in 2004.

Despite being time-starved, entrepreneurs say they would want to mentor more of these younger startups as they are likely to be the future growth engines for the ecosystem. Mukesh Bansal, co-founder of fashion e-commerce portal Myntra, which merged with Flipkart recently, says the energy behind new businesses is what attracts him to angel investing. "It's not about deploying money alone but about knowing what new ideas people are coming up with." Bansal, who heads Myntra and Flipkart's fashion vertical, has invested in Urban Touch, sold toFashionandyou.com; ZopNow, an online grocer; and Sasha Mirchandani's Kae Capital, an early stage fund.

While the trend is still nascent in India, there are institutionalized groups for entrepreneur angels in the Valley- the mecca for startups and investors. Besides, with many more founders exiting their companies via acquisitions or IPOs the flow of funds from entrepreneurs, past and present, is inimitable there. Some of the most prolific entrepreneur angels emerged after online payments gateway PayPal was sold to eBay creating a group nicknamed 'PayPal Mafia'. This fabled group has been credited with inspiring the re-emergence of consumer-focused Internet companies post the dotcom bust in 2001. The likes of Peter Thiel and Reid Hoffman, have since emerged as some of the biggest investors the Valley has seen over the past decade.

Back home, Anshul Gupta, another IITian who co-founded Box8, a Mumbai-based fast-food chain, says Mu Sigma's Rajaram's has been a guiding force for the company. "Even if I make a few calls to him or correspond through emails it helps me immensely in solving critical issues," he says.

However, others feel companies need to attain a certain size for their founders to go and invest elsewhere. Additionally, VCs feel at some level there is a conflict of interest when an existing entrepreneur they have invested in starts competing with them in spotting ideas and startups.

"But it's much more than capital in the seed stage, these young startups need hand-holding to build and scale up their businesses," says Pearl Uppal, founder of fashionandyou.com, 5Ideas and a partner in Startup Superfuel. 5ideas, launched by Uppal and her husband Gaurav Kachru, is a platform for accelerating the tech startup ecosystem in the country.

(Inputs from Shilpa Phadnis in Bangalore)

India saw the first wave of entrepreneur angels when the likes of Makemytrip's Deep Kalra and Naukri.com founder Sanjeev Bikhchandani took their companies public.However, this time around most of the angel investing is being done by existing entrepreneurs who are in the thick of running their own businesses. Whether it's Sachin and Binny Bansal of Flipkart, Snapdeal's founders Kunal Bahl and Rohit Bansal, Mu Sigma's Dhiraj Rajaram or InMobi's Naveen Tewari, they are all keenly investing in new ideas — a sign of the overall startup ecosystem maturing in the country along the lines of Silicon Valley.

Angel investing is typically done at a very early stage of a company's life, and startups say they gain significantly from these entrepreneur angels. "Who better to know the high potential and market opportunities than existing entrepreneurs? This is great for the ecosystem. It also highlights the fact that this new breed of young entrepreneurs is truly putting its money where its mouth is. I find this very exciting for the future of value creation in the Indian market," says one-time entrepreneur Avnish Bajaj, MD at VC fund Matrix Partners India. Bajaj, along with his Harvard Business School classmate Suvir Sujan, founded India's largest online auction site Baazee, which was later acquired by eBay in 2004.

IIT-graduate Bhavish Aggarwal, co-founder of OlaCabs, a technology backed taxi service startup, says he met Snapdeal's Bahl at an entrepreneurship event in Mumbai when Ola was still bootstrapped. A few meetings later, Bahl along with his co-founder Bansal, and Zishaan Hayath, founder of online test prep portal Toppr.com, seed-funded him. "We're all facing the same challenges and it was great to exchange notes with them," says Aggarwal. Since then, Ola has raised two rounds of institutional funding from marquee VCs like Tiger Global and Matrix Partners but having mentors like Bahl and Hayath was crucial in the initial phase, says Aggarwal.

Despite being time-starved, entrepreneurs say they would want to mentor more of these younger startups as they are likely to be the future growth engines for the ecosystem. Mukesh Bansal, co-founder of fashion e-commerce portal Myntra, which merged with Flipkart recently, says the energy behind new businesses is what attracts him to angel investing. "It's not about deploying money alone but about knowing what new ideas people are coming up with." Bansal, who heads Myntra and Flipkart's fashion vertical, has invested in Urban Touch, sold toFashionandyou.com; ZopNow, an online grocer; and Sasha Mirchandani's Kae Capital, an early stage fund.

While the trend is still nascent in India, there are institutionalized groups for entrepreneur angels in the Valley- the mecca for startups and investors. Besides, with many more founders exiting their companies via acquisitions or IPOs the flow of funds from entrepreneurs, past and present, is inimitable there. Some of the most prolific entrepreneur angels emerged after online payments gateway PayPal was sold to eBay creating a group nicknamed 'PayPal Mafia'. This fabled group has been credited with inspiring the re-emergence of consumer-focused Internet companies post the dotcom bust in 2001. The likes of Peter Thiel and Reid Hoffman, have since emerged as some of the biggest investors the Valley has seen over the past decade.

Back home, Anshul Gupta, another IITian who co-founded Box8, a Mumbai-based fast-food chain, says Mu Sigma's Rajaram's has been a guiding force for the company. "Even if I make a few calls to him or correspond through emails it helps me immensely in solving critical issues," he says.

However, others feel companies need to attain a certain size for their founders to go and invest elsewhere. Additionally, VCs feel at some level there is a conflict of interest when an existing entrepreneur they have invested in starts competing with them in spotting ideas and startups.

"But it's much more than capital in the seed stage, these young startups need hand-holding to build and scale up their businesses," says Pearl Uppal, founder of fashionandyou.com, 5Ideas and a partner in Startup Superfuel. 5ideas, launched by Uppal and her husband Gaurav Kachru, is a platform for accelerating the tech startup ecosystem in the country.

(Inputs from Shilpa Phadnis in Bangalore)

End of Article

FOLLOW US ON SOCIAL MEDIA