- India

- International

Minimising role of politicians turned around state’s top cooperative bank: minister

The reforms by state govt to minimise the politicians' role in the MSCB has made from Rs 1800 cr loss in 2010-11 to Rs 600 cr in profit in 2013-14.

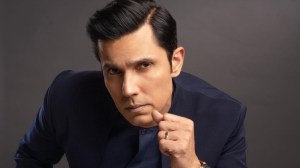

The reforms undertaken by the state government to minimise the role of politicians in the functioning of the Maharashtra State Cooperative Bank (MSCB) has turned it around in three years, from accumulated losses of Rs 1800 crore in financial year 2010-11 to Rs 600 crore in profit in 2013-14, according to state’s Minister for Cooperatives and Parliamentary Affairs Harshvardhan Patil.

In an interview to The Indian Express, Patil said, “Political interference in running the MSCB or district cooperative banks has caused immense damage to these institutions. My ministry had to take stern measures to set the system right and restore the faith of depositors in coperative banks.”

According to Patil, “After objections from the Reserve Bank of India (RBI) over MSCB’s functioning, we dismissed the existing board of directors and appointed IAS officers as administrators. We followed guidelines that no loans should be given to relatives or family members of the board’s directors and that individuals taking loans should have repaying capacity of thrice the loan amount.” “We cannot overlook the fact that money in these banks belongs to depositors,” he said.

Patil said the turnaround was made possible through recovery, attachment of assets and financial support from the government.

The minister said there were serious problems, including of direct interference of politicians in the functioning of the MSCB and other district cooperative banks that lead to financial mismanagement and losses to these institutions. Spelling out five steps taken by his department, he said, “No ad hoc loans will be given to any of the family members of politicians or of directors. There should be no unsecured loans. It should be loaned against the property, whose value should be at least three times more than the loan amount sanctioned. Regular audit in the bank is a must and balance sheet should be circulated to every member on the board to bring transparency and accountability.”

He said, “Professional management was the only way to fix the shortcomings in the MSCB and district cooperative banks where individuals (politicians) treated these as their personal account.”

According to the minister, the average daily deposit in these banks together is as high as Rs 25,000 crore. the figure for the 28 district cooperative banks, 535 urban cooperative banks and 21,000 credit societies across Maharashtra stands at Rs four lakh crore.

Apart from the MSCB, there were 11 district cooperative banks which were bleeding – Nagpur, Wardha, Buldhana, Kolhapur, Dhulia, Nashik, Beed, Nanded, Osmanabad, Sangli and Jalna.

While the state government’s financial help coupled with stringent action have salvaged MSCB and other nine district banks, there are concerns related to Nagpur, Wardha and Buldana district cooperative banks.

Apr 18: Latest News

- 01

- 02

- 03

- 04

- 05