- News

- Business News

- India Business News

- Fund houses line up FMP issues

Trending

This story is from March 5, 2014

Fund houses line up FMP issues

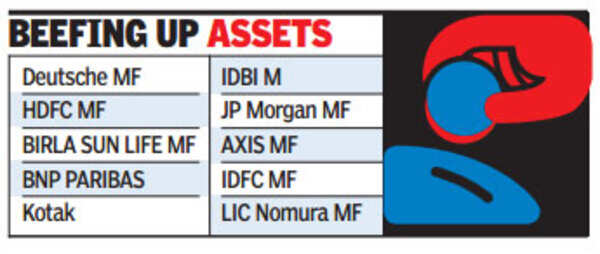

The coming weeks will see a surge in fixed maturity plan issues by mutual funds.Almost every large fund house has drawn up plans for an FMP in a hope to beef up assets under management.

MUMBAI: The coming weeks will see a surge in fixed maturity plan issues by mutual funds. Almost every large fund house has drawn up plans for an FMP in a hope to beef up assets under management. One of the major advantages of investing in an FMP is that for tax purposes, returns can be adjusted for inflation. Considering that RBI has forecast 6% inflation by January 2015, investors can avoid an income tax liability in an FMP with double indexation benefit, which makes it virtually a tax-free investment.

The double-indexation benefit is a tax loophole which allows investors to claim indexation benefit on an investment across two fiscals, even if the tenure of the mutual fund is only 370 days. This is how it works: If a fund is launched towards the end of March 2014 and has a maturity of 370 days, the scheme will be redeemed only in April 2016. This will result in the purchase and sale being spread over two financial years, allowing the investor to take advantage of adjusting returns for inflation for two financial years.

"March is also a time when there is tightness in the money market because of advance tax payments to the government. This gives mutual funds an opportunity to invest in certificate of deposits (CDs), which provide a return of up to 9.8%," said Nilesh Sathe, CEO, LIC Mutual Fund. Besides CDs, several top-rated corporates offer high returns on commercial papers. Since FMPs are close-ended, MFs can come up with NFOs, which allow for more intensive marketing rather that sell through distributors.

Although FMPs have much lower fee earnings compared to equity funds or long-term funds, the volumes are very high as investors see these as a substitute for fixed deposits. Investors have the option to choose the income or growth option. In the income option, returns are taxed at 12.5%. But in the growth option, a long-term capital gains tax of 20% is applicable if the investor chooses to offset his return against inflation (indexation benefit). Without the indexation benefit, capital gains tax of 10% is applicable.

Although FMPs are targeted at fixed deposit investors, there is an element of credit risk as highly rated companies have also slipped suddenly into default. But such defaults are rare and investments in CDs of public sector banks are considered risk free by mutual funds. UBI, the only distressed public sector bank, has also redeemed its CDs in time despite its problem with bad loans.

The double-indexation benefit is a tax loophole which allows investors to claim indexation benefit on an investment across two fiscals, even if the tenure of the mutual fund is only 370 days. This is how it works: If a fund is launched towards the end of March 2014 and has a maturity of 370 days, the scheme will be redeemed only in April 2016. This will result in the purchase and sale being spread over two financial years, allowing the investor to take advantage of adjusting returns for inflation for two financial years.

"March is also a time when there is tightness in the money market because of advance tax payments to the government. This gives mutual funds an opportunity to invest in certificate of deposits (CDs), which provide a return of up to 9.8%," said Nilesh Sathe, CEO, LIC Mutual Fund. Besides CDs, several top-rated corporates offer high returns on commercial papers. Since FMPs are close-ended, MFs can come up with NFOs, which allow for more intensive marketing rather that sell through distributors.

Last financial year, over Rs 70,000 crore was raised through FMPs - much lower than the Rs 1.3-lakh crore raised in FY12. This year mutual funds are hoping to better last fiscal's collections if yields rise in mid-March.

Although FMPs have much lower fee earnings compared to equity funds or long-term funds, the volumes are very high as investors see these as a substitute for fixed deposits. Investors have the option to choose the income or growth option. In the income option, returns are taxed at 12.5%. But in the growth option, a long-term capital gains tax of 20% is applicable if the investor chooses to offset his return against inflation (indexation benefit). Without the indexation benefit, capital gains tax of 10% is applicable.

Although FMPs are targeted at fixed deposit investors, there is an element of credit risk as highly rated companies have also slipped suddenly into default. But such defaults are rare and investments in CDs of public sector banks are considered risk free by mutual funds. UBI, the only distressed public sector bank, has also redeemed its CDs in time despite its problem with bad loans.

End of Article

FOLLOW US ON SOCIAL MEDIA